Greaves Cotton Ltd. was listed on the NSE on September 9, 2004. In just one year, it gave a massive return of more than 70%. Will Greaves Cotton continue to provide such impressive returns in 2025 and future years as well? Let’s explore the Greaves Cotton growth potential and Greaves Cotton share price target 2025 to 2050 in this article.

About Greaves Cotton

Greaves Cotton Ltd. was established in 1859, it manufactures and markets a wide range of industrial products, including engines, power generation equipment, and electric mobility solutions. The company operates through five independent business units: Greaves Engineering, Greaves Electric Mobility, Greaves Retail, Greaves Finance, and Greaves Technologies.

Greaves Cotton Business Model

- Engineering and Manufacturing Business: Greaves Cotton is a diverse engineering company that manufactures engines, powertrains, and related solutions. The company offers diesel, CNG, and electric engines for automotive, agricultural, and industrial applications.

- E-Mobility and Electric Vehicles (EV): Greaves Cotton has entered the electric mobility market through its subsidiary, Greaves Electric Mobility. The company manufactures and sells electric two- and three-wheelers under the brand name Ampere.

- Aftermarket Services and Spare Parts: Greaves Cotton offers complete aftermarket services, such as the sale of spare parts and maintenance, to ensure recurring revenue through ongoing customer engagement. The company’s wide distribution and service network in India supports this segment.

- Rental and Leasing Solutions: Greaves Cotton rents and leases industrial equipment and generators. This segment ensures consistent cash flow by operating under long-term rental agreements.

Greaves Cotton Fundamental Analysis

| Stock Name | Greaves Cotton Ltd. |

|---|---|

| Market Cap | ₹ 4,722 Cr. |

| 52W High | ₹ 320 |

| 52W Low | ₹ 112 |

| Stock P/E (TTM) | 87.32 |

| Book Value | ₹ 58.4 |

| Dividend Yield | 0.98 % |

| ROCE | 3.72 % |

| ROE | 1.62 % |

| Face Value | ₹ 2 |

| Cash Reserves | ₹ 1,312 Cr. |

| Share holder | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 55.74% | 56.00% | 55.88% |

| FIIs | 4.54% | 2.81% | 2.86% |

| DIIs | 4.22% | 3.75% | 3.31% |

| Public | 35.50% | 37.43% | 37.93% |

| No. of Shareholders | 2,21,327 | 2,05,042 | 3,01,509 |

Key Factors Driving Greaves Cotton Growth

- Expansion into Electric Mobility: Greaves Cotton has profited from India’s growing demand for electric vehicles (EVs) through Greaves Electric Mobility, a subsidiary. Greaves Electric Mobility produces e-scooters under the ‘Ampere’ brand. In December 2024, the company filed DRHP with the Securities and Exchange Board of India (SEBI) for an IPO to raise 1,000 crore. This demonstrates the company’s commitment to expanding its presence in the EV market.

- Expansion of Product Portfolio and Fuel-Agnostic Approach: Greaves Cotton adopted a fuel-agnostic strategy, developing engines that are compatible with diesel, CNG, and electric powertrains. This strategy has expanded its market reach while reducing dependency on traditional diesel engines. In Q1 FY25, the company introduced new alternative fuel engines and switched to CPCB IV+ gensets, which received a positive market response.

- Strategic Acquisitions and Partnerships: The acquisition of Excel Controlinkage added value by strengthening Greaves Cotton’s control system capabilities and expanding its product offerings. Excel generated ₹61 crore in quarterly revenue in Q2 FY25, with exports accounting for roughly 30%.

- Strengthening Aftermarket Services and Retail Network: Greaves Cotton has over 10,000 retailers and 250 distributors, and its expansion includes digital initiatives such as the ‘Greaves Care’ app and a mechanic loyalty program. This extensive network ensures recurring revenue by providing ongoing customer engagement and support.

Pros of Greaves Cotton

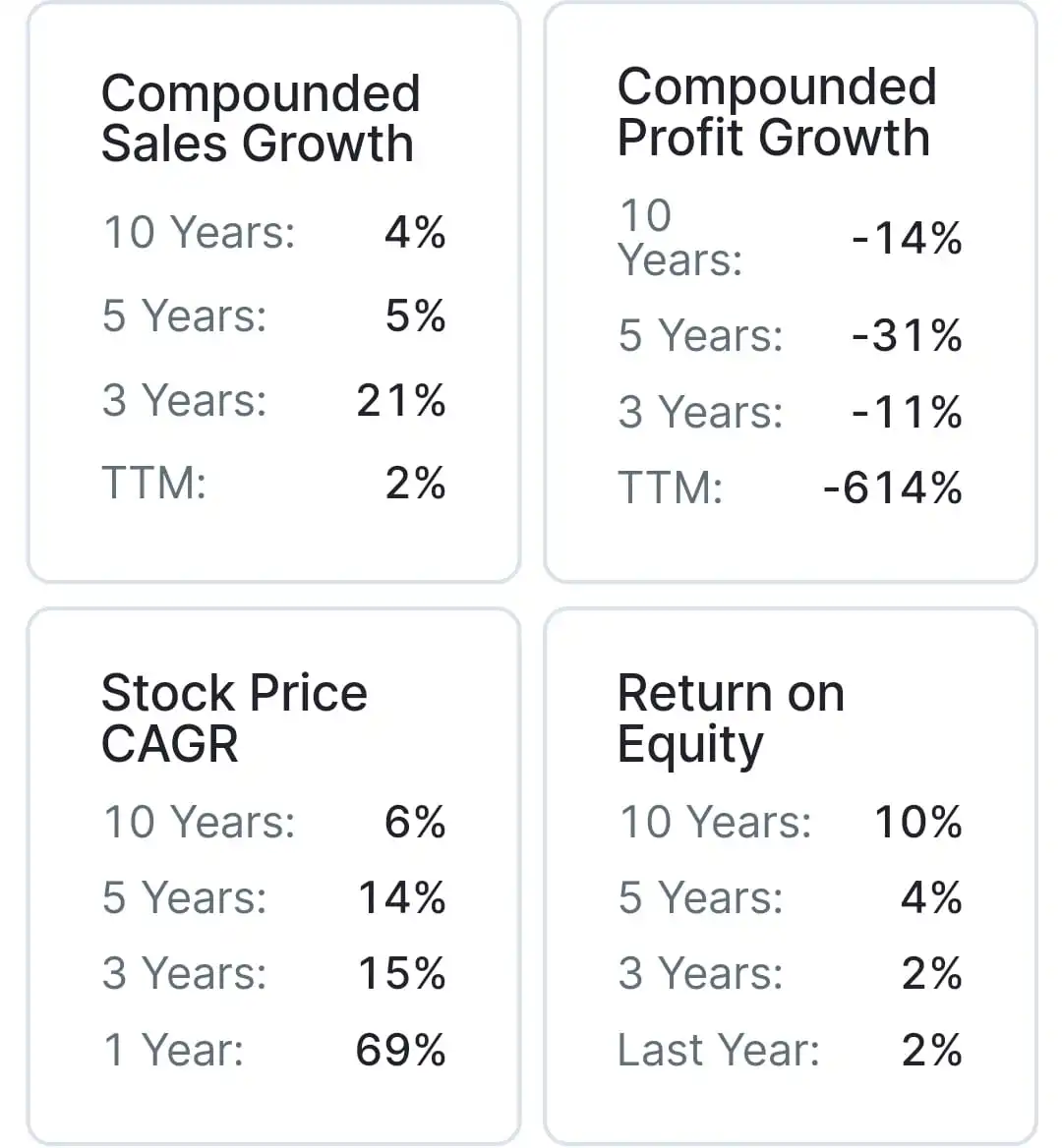

- Strong Sales Growth: Greaves Cotton sales have grown at 21% CAGR over the last 3 years.

- Debt Free Company: Greaves Cotton is almost a debt-free company with a debt to equity ratio of 0.06, which shows its financial stability.

- Increase in FIIs Holding: Foreign Institutional Investors (FIIs) have increased their holding from 2.41% in December 2024 to 2.86% in March 2025, which indicates growing confidence in Greaves Cotton’s future potential by the FIIs.

Cons of Greaves Cotton

- Decreasing Profits – Greaves Cotton’s profits have been decreasing at a CAGR of 31% over the last 5 Years.

- Low Return on Equity (ROE): Greaves Cotton’s 5-year average ROE is 4.36%, which shows that it is not using its shareholders’ funds efficiently to generate profits.

- Low Return on Capital Employed (ROCE): Greaves Cotton’s 5-year average ROCE is 6.61%, which shows that it is not using its capital efficiently to generate profits.

- High Price to Book Value: Greaves Cotton’s stock is trading at a Price-to-Book Value (P/B) ratio of 3.48, which indicates that its stock is significantly overvalued compared to its book value.

By the end of 2025, the Greaves Cotton share price is expected to be around ₹275 in a normal case. In bear market, it might be ₹250, and in bull market, it may cross ₹310.

| Greaves Cotton Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 250 |

| 2nd Target | 275 |

| 3rd Target | 310 |

In 2026, the Greaves Cotton share price is expected to be around ₹360 in a normal case. In a bear market, it might be ₹300, and in a bull market, it may cross ₹410.

| Greaves Cotton Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 300 |

| 2nd Target | 360 |

| 3rd Target | 410 |

In 2027, the Greaves Cotton share price is expected to be around ₹440 in a normal case. In a bear market, it might be ₹360, and in a bull market, it may cross ₹530.

| Greaves Cotton Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 360 |

| 2nd Target | 440 |

| 3rd Target | 530 |

In 2028, the Greaves Cotton share price is expected to be around ₹525 in a normal case. In a bear market, it might be ₹430, and in a bull market, it may cross ₹690.

| Greaves Cotton Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 430 |

| 2nd Target | 525 |

| 3rd Target | 690 |

In 2029, the Greaves Cotton share price is expected to be around ₹675 in a normal case. In a bear market, it might be ₹520, and in a bull market, it may cross ₹900.

| Greaves Cotton Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 520 |

| 2nd Target | 675 |

| 3rd Target | 900 |

In 2030, the Greaves Cotton share price is expected to be around ₹860 in a normal case. In a bear market, it might be ₹620, and in a bull market, it may cross ₹1120.

| Greaves Cotton Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 620 |

| 2nd Target | 860 |

| 3rd Target | 1120 |

In 2035, the Greaves Cotton share price is expected to be around ₹1800 in a normal case. In a bear market, it might be ₹1200, and in a bull market, it may go up to ₹3500.

| Greaves Cotton Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 1200 |

| 2nd Target | 1800 |

| 3rd Target | 3500 |

In 2040, the Greaves Cotton share price is expected to be around ₹4200 in a normal case. In a bear market, it might be ₹2450, and in a bull market, it may go up to ₹10,500.

| Greaves Cotton Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 2450 |

| 2nd Target | 4200 |

| 3rd Target | 10,500 |

In 2050, the Greaves Cotton share price is expected to be around ₹22,000 in a normal case. In a bear market, it might be ₹10,000, and in a bull market, it may go up to ₹60,000.

| Greaves Cotton Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 10,000 |

| 2nd Target | 22,000 |

| 3rd Target | 60,000 |

| Years | Target Price |

|---|---|

| Greaves Cotton Share Price Target 2025 | ₹250 to ₹310 |

| Greaves Cotton Share Price Target 2026 | ₹300 to ₹410 |

| Greaves Cotton Share Price Target 2027 | ₹360 to ₹530 |

| Greaves Cotton Share Price Target 2028 | ₹430 to ₹690 |

| Greaves Cotton Share Price Target 2029 | ₹520 to ₹900 |

| Greaves Cotton Share Price Target 2030 | ₹620 to ₹1120 |

| Greaves Cotton Share Price Target 2035 | ₹1200 to ₹3500 |

| Greaves Cotton Share Price Target 2040 | ₹2,450 to ₹10,500 |

| Greaves Cotton Share Price Target 2050 | ₹10,000 to ₹60,000 |

Greaves Cotton Latest Earnings

Greaves Cotton showed significant growth in both net profit and revenue in Q3 2025. The company’s net profit rose 64% year-on-year (YoY) to ₹20.8 crore from ₹12.7 crore in the Q3 2024, highlighting a strong performance for the quarter ended December 2024. While its revenue for the quarter rose by 12.8% YoY, reaching ₹750.6 crore, compared to ₹665.4 crore in the Q3 2024.

Greaves Cotton’s EBITDA increased 12% year on year to ₹39.7 crore, up from ₹35.4 crore in Q3 2024. However, the EBITDA margin remained flat at 5.3%, consistent with the previous year’s results.

Conclusion

Greaves Cotton’s future looks promising, thanks to its strategic expansion into electric mobility and diverse engineering portfolio. Greaves Cotton is well-positioned to capitalise on emerging opportunities as demand for sustainable transportation and industrial solutions increases. The company’s focus on electric vehicles, aftermarket services, and acquisitions strengthens its market position. While stock performance can vary, Greaves Cotton’s consistent innovation and strong business model make it a strong candidate for long-term growth and investment.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: NHPC Share Price Target 2025 to 2050