Varun Beverages Ltd. (VBL) was listed on the NSE and BSE on November 8, 2016. In the last 5 years, its stock VBL gave a massive return of around 800% to its investors. Will VBL continue to provide such impressive returns in the future as well? Let’s explore Varun Beverages’ future growth potential and the Varun Beverages share price target 2025 to 2050.

About Varun Beverages Ltd.

Varun Beverages Limited (VBL) is one of PepsiCo’s largest franchisees around the world. The company was established in 1995 and manufactures, bottles, and distributes carbonated soft drinks, non-carbonated beverages, and packaged drinking water under the PepsiCo brand. VBL operates in India and several other countries, including Sri Lanka, Nepal, Morocco, and Zambia. The company manufactures and sells well-known brands like Pepsi, Mountain Dew, Mirinda, Tropicana, Aquafina, and Sting.

VBL Business Model

- Manufacturing and Bottling: VBL earns money by manufacturing and bottling PepsiCo beverages, including carbonated soft drinks, juices, and packaged water.

- Food Products Sales: In addition to beverages, VBL also sells PepsiCo’s food products such as Lay’s, Kurkure, and Doritos, further boosting its revenue.

- Exclusive Franchisee of PepsiCo: VBL has the rights to produce and distribute PepsiCo products in India and several international markets like Nepal, Sri Lanka, Morocco, and Zambia, giving it a strong market position.

- Distribution and Sales: The company distributes its products through a vast network of retailers, supermarkets, restaurants, and vending machines, ensuring high sales volume.

VBL Fundamental Analysis

| Stock Name | Varun Beverages Ltd. |

|---|---|

| NSE Symbol | VBL |

| Market Cap | ₹ 1,72,137 Cr. |

| 52W High | ₹ 683 |

| 52W Low | ₹ 419 |

| Stock P/E | 61.8 |

| Book Value | ₹ 49.1 |

| Dividend Yield | 0.20 % |

| ROCE | 24.8 % |

| ROE | 22.5 % |

| Face Value | ₹ 2.0 |

| Industry PE | 30.2 |

| Price to book value | 10.3 |

| Debt to equity | 0.17 |

| PEG Ratio | 1.49 |

| Quick ratio | 1.12 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 63.90% | 62.91% | 60.23% |

| FIIs | 26.00% | 25.79% | 22.98% |

| DIIs | 3.67% | 4.16% | 9.19% |

| Public | 6.41% | 7.16% | 7.59% |

| No. of Shareholders | 2,61,286 | 4,89,887 | 8,73,915 |

Key Factors Driving VBL’s Future Growth

- Strong Demand for Beverages and Snacks: VBL benefits from the growing demand for soft drinks, juices, and packaged snacks in India and other markets, leading to higher sales.

- Expansion in New Markets: VBL added a geographical presence in South Africa with distribution rights in Namibia, Botswana, Mozambique, and Madagascar.

- Growing Rural Market Reach: VBL is increasing its focus on rural areas, where demand for packaged beverages and snacks is rising due to better distribution networks and changing lifestyles.

- Increase in Out-of-Home Consumption: As more people eat and drink outside their homes, demand for VBL’s products in restaurants, cafes, and vending machines is increasing.

- Introduction of New Products: VBL regularly launches new beverages and snacks under PepsiCo’s brand, helping it attract more customers and increase sales.

- Expanding Manufacturing Capacity: VBL is setting up new plants and upgrading existing ones to meet growing demand, ensuring it can produce more products efficiently.

- Better Supply Chain and Logistics: VBL is improving its supply chain to reduce costs and ensure its products reach customers faster, increasing sales and profit margins.

- Rising Disposable Income in India: As people earn more, they are spending more on branded beverages and snacks, increasing demand for VBL’s products.

- Upcoming product launch: The upcoming launch of Sting Gold in the energy drink segment will help VBL attract more customers and boost sales.

Pros of Varun Beverages

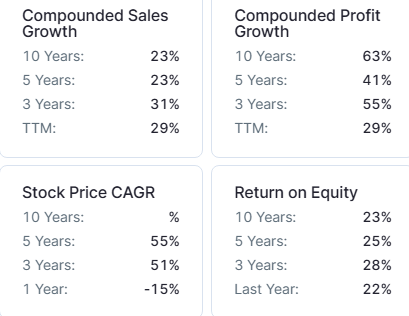

- Strong Revenue and Profit Growth: VBL’s revenue has grown at a CAGR of 23%, and its profit has grown at a CAGR of 42.6% over the last five years, showing strong financial performance.

- Market Leader in Beverages: VBL is one of the largest franchisees of PepsiCo, giving it a strong position in the beverage market with popular brands like Pepsi, Mountain Dew, and Tropicana.

- Diversified Product Portfolio: VBL earns from a variety of products, including carbonated drinks, juices, packaged water (Aquafina), and snacks like Lay’s and Kurkure, ensuring stable revenue.

- Focus on Healthier Beverages: VBL launched low and no-sugar products, now comprising 53% of consolidated sales volume, catering to health-conscious consumers.

- High Return on Equity (ROE) and Return on Capital Employed (ROCE): As of December 2024, VBL’s ROE is 24.5% and ROCE is 21.3%, reflecting efficient use of funds to generate profits.

- Management Confidence: VBL’s management remains confident in achieving double-digit growth despite competition from brands like Campa.

- Almost Debt-Free: VBL has reduced its debt significantly over the years, improving its financial stability and reducing interest costs.

- Increase in Institutional Holding: FIIs increased their stake in VBL to 25.27% in December 2024 from 24.18% in September 2024, while DIIs raised their stake to 7% from 4.97% during the same period, reflecting strong investor confidence in the company’s future growth.

Cons of Varun Beverages

- High Valuation: As of February 2025, VBL’s stock is trading at a P/E ratio of 62.2 and a P/B ratio of 9.7, making it more expensive than industry peers.

- Growing Competition from Campa Cola: Reliance’s Campa Cola brand is aggressively expanding in India, offering cheaper alternatives to Pepsi and Coca-Cola. This could impact VBL’s market share and pricing power.

- Dependence on PepsiCo: VBL’s business relies heavily on PepsiCo’s franchise agreement. Any changes or termination of this agreement could have a serious impact on its operations.

- Rising Input Costs: The prices of sugar, PET bottles, and aluminum cans have been increasing, which may reduce profit margins if costs are not passed on to consumers.

- Regulatory and Health Concerns: With rising health awareness and potential sugar taxes, demand for carbonated soft drinks may decline, affecting VBL’s growth.

- Declining Promoter Holding: Promoter stake fell from 62.66% in September 2024 to 60.20% in December 2024, raising concerns about promoter commitment.

Varun Beverages Balance Sheet

| Particulars | Dec 2022 | Dec 2023 | Dec 2024 |

|---|---|---|---|

| Equity Capital | 650 | 650 | 676 |

| Reserves | 4,453 | 6,287 | 15,934 |

| Borrowings | 3,884 | 5,431 | 2,826 |

| Other Liabilities | 2,632 | 2,819 | 3,688 |

| Total Liabilities | 11,618 | 15,187 | 23,124 |

| Fixed Assets | 6,932 | 8,409 | 13,402 |

| CWIP | 607 | 1,922 | 1,167 |

| Investments | 0 | 21 | 60 |

| Other Assets | 4,079 | 4,835 | 8,496 |

| Total Assets | 11,618 | 15,187 | 23,124 |

By the end of 2025, the Varun Beverages share price is expected to be around ₹720 in normal conditions. In a bear market, it might be ₹650, and in a bull market, it may go up to ₹800.

| Varun Beverages Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 650 |

| 2nd Target | 720 |

| 3rd Target | 800 |

In 2026, the Varun Beverages share price is expected to be around ₹800 in a normal situation. In a bear market, it might be ₹750, and in a bull market, it may cross ₹1050.

| Varun Beverages Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 750 |

| 2nd Target | 800 |

| 3rd Target | 1050 |

According to our analysis, the Varun Beverages share price is expected to be around ₹1050 in 2027. In a bear market, it might be ₹900, and in a bull market, it may cross ₹1350.

| Varun Beverages Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 900 |

| 2nd Target | 1050 |

| 3rd Target | 1350 |

According to our analysis, the Varun Beverages share price may trade near ₹1300 by 2028; bearish conditions could pull it down to ₹1100, while a strong bull run might lift it to ₹1750.

| Varun Beverages Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 1100 |

| 2nd Target | 1300 |

| 3rd Target | 1750 |

In a normal situation, the Varun Beverages share price is projected to be approximately ₹1600 in 2029. In a bear market, the value may be as low as ₹1300, while in a bull market, it may rise to ₹2250.

| Varun Beverages Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 1300 |

| 2nd Target | 1600 |

| 3rd Target | 2250 |

In a normal situation, the Varun Beverages share price is projected to be approximately ₹1900 in 2030. In a bear market, the value may be as low as ₹1550, while in a bull market, it may rise to ₹2900.

| Varun Beverages Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 1550 |

| 2nd Target | 1900 |

| 3rd Target | 2900 |

By 2035, the Varun Beverages share price is projected to be around ₹5000 under normal conditions. In adverse markets, the price could fall to ₹3100, while favorable conditions might push it up to ₹8700.

| Varun Beverages Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 3100 |

| 2nd Target | 5000 |

| 3rd Target | 8700 |

Under normal conditions, the Varun Beverages share price might hit ₹15,000 by 2040. A bearish trend could lower it to ₹6200, whereas a bullish surge could raise it to ₹26,000.

| Varun Beverages Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 6200 |

| 2nd Target | 15,000 |

| 3rd Target | 26,000 |

In 2050, the Varun Beverages share price is expected to be around ₹70,000 in a normal situation. In a bear market, it might be ₹24,800, and in a bull market, it may go up to ₹1,56,500.

| Varun Beverages Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 24,800 |

| 2nd Target | 70,000 |

| 3rd Target | 1,56,500 |

| Years | Target Price |

|---|---|

| Varun Beverages Share Price Target 2025 | ₹650 to ₹800 |

| Varun Beverages Share Price Target 2026 | ₹750 to ₹1050 |

| Varun Beverages Share Price Target 2027 | ₹900 to ₹1350 |

| Varun Beverages Share Price Target 2028 | ₹1100 to ₹1750 |

| Varun Beverages Share Price Target 2029 | ₹1300 to ₹2250 |

| Varun Beverages Share Price Target 2030 | ₹1550 to ₹2900 |

| Varun Beverages Share Price Target 2035 | ₹3100 to ₹8700 |

| Varun Beverages Share Price Target 2040 | ₹6200 to ₹26,000 |

| Varun Beverages Share Price Target 2050 | ₹24,800 to ₹1,56,500 |

Conclusion

Varun Beverages Ltd. (VBL) has shown impressive growth over the years, delivering strong returns to investors. As one of PepsiCo’s largest franchisees, VBL benefits from a strong product portfolio, expanded market reach, and rising demand for beverages and snacks. To attract more customers, the company is launching healthier and more innovative products such as Sting Gold. However, issues such as high valuation, increased competition from Campa Cola, and dependency on PepsiCo remain concerns. Despite these risks, VBL’s strong financials, expanding operations, and growing institutional investor confidence indicate a promising future for the company. For the latest updates, check the VBL official website.

FAQ’s

What is Varun Beverages Ltd. (VBL)?

Varun Beverages Ltd. (VBL) is one of PepsiCo’s largest franchisees, engaged in manufacturing, bottling, and distributing PepsiCo’s beverages and snacks in India and several international markets.

The expected share price target for VBL in 2025 is between ₹650 and ₹800.

By 2030, the VBL share price is projected to range between ₹1550 and ₹2900.

The estimated share price target for VBL in 2035 is between ₹3100 and ₹8700.

VBL share price is expected to be between ₹6200 and ₹26,000 by 2040.

By 2050, the VBL share price is projected to reach between ₹24,800 and ₹1,56,500.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.