Read Time: 5 minutes

Tata Steel was listed on the NSE and BSE on November 18, 1998. From then till now, its stock gave a massive return of 3000%. Will Tata Steel continue to provide such impressive returns in 2025 and future years as well? In this article, we will explore Tata Steel growth potential and Tata Steel share price target from 2025 to 2050.

About Tata Steel

Tata Steel is one of the world’s largest steel-producing companies and a part of the flagship Tata Group. Tata Steel was established in 1907; it is headquartered in Jamshedpur, India. Tata Steel is known for producing high-quality steel products used in industries like construction, automotive, and infrastructure. With a strong presence in over 50 countries, the company operates major steel plants in India, Europe, and Southeast Asia.

Tata Steel Fundamental Analysis

| Stock Name | Tata Steel |

|---|---|

| NSE Symbol | TATASTEEL |

| Market Cap | ₹ 1,62,635 Cr. |

| 52W High | ₹ 185 |

| 52W Low | ₹ 123 |

| Stock P/E (TTM) | 53.4 |

| Book Value | ₹ 72.2 |

| Dividend Yield | 2.76 % |

| ROCE | 7.02 % |

| ROE | 6.55 % |

| Face Value | ₹ 1 |

| Industry PE | 18.1 |

| Price to Book Value | 1.91 |

| Debt to equity | 1.10 |

| Interest Coverage Ratio | 2.23 |

| PEG Ratio | -10.4 |

| Quick Ratio | 0.25 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 33.90% | 33.19% | 33.19% |

| FIIs | 20.62% | 19.61% | 18.29% |

| DIIs | 20.68% | 23.51% | 24.48% |

| Government | 0.16% | 0.16% | 0.18% |

| Public | 24.63% | 23.52% | 23.84% |

| No. of Shareholders | 36,44,090 | 47,17,442 | 60,25,709 |

Key Factors Driving Tata Steel’s Future Growth

- Capacity Expansion: Tata Steel plans to increase its crude steel production capacity in India from 21 million tonnes per annum (MnTPA) to 40 MnTPA by 2030.

- Strategic Partnerships: Tata Steel does a joint venture with BlueScope Steel for pre-engineered steel products to enhance Tata Steel’s product offerings and market reach.

- Market Demand: India’s strong economic growth, fueled by infrastructure development and manufacturing activities, presents significant opportunities for Tata Steel to expand.

- Government Support: The UK government invests £500 million in Tata Steel’s Port Talbot plant, which supports the transition to electric arc furnace steelmaking.

Pros of Tata Steel

- Strong Market Position: Tata Steel is one of the largest steel producers globally, with a strong presence in key markets like India, Europe, and Southeast Asia.

- Increase in DIIs Holding: Domestic Institutional Investors (DIIs) have increased their holding in Tata Steel to 24.48% in March 2025 from 23.52% in December 2024, which indicates growing confidence in the Tata Steel’s future potential by the DIIs.

- Low P/B Ratio: Tata Steel’s Price to Book Value (P/B) ratio is 1.91, which shows that the stock is trading close to its intrinsic value and may be undervalued.

- Diversified Product Portfolio: The company offers a wide range of steel products that serve various industries such as construction, automotive, infrastructure, and defense.

- Capacity Expansion Plans: Tata Steel’s aggressive expansion strategy in India and abroad positions the company to benefit from rising global and domestic steel demand.

- Government Initiatives: Tata Steel gets benefits from India’s “Make in India” and infrastructure development projects, which drive demand for steel products.

- Operational Efficiency: The company continually invests in automation, digitalization, and cost management to maintain profitability and competitive pricing.

- Focus on Value-Added Products: Tata Steel is increasing its share of high-margin, value-added steel products, which enhances profitability and reduces exposure to commodity price fluctuations.

- Economic Growth Catalyst: As India’s economy grows, the demand for steel in construction, manufacturing, and infrastructure is expected to increase, providing a tailwind for Tata Steel’s business.

Cons of Tata Steel

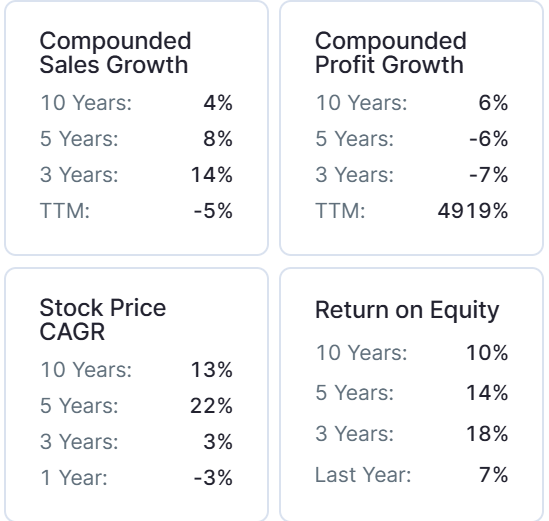

- Poor Sales Growth – Tata Steel has delivered a poor sales growth of 4% over the last 10 years.

- Poor Profit Growth – Tata Steel profit has grown at a CAGR of just 6% over the last 10 years, showing weak earnings growth over time.

- Overvaluation Concern: Tata Steel stock is trading at a PE ratio of 60.9, which is relatively higher than the industry average of 18.1, indicating that the stock is overvalued compared to its peers.

- High Financial Risk: Tata Steel has a high debt-to-equity ratio of 1.10, indicating a strong dependency on debt. This increases financial risk, raises interest costs, and may have an impact on profitability.

- Losses in Overseas Units: Operations in the UK face challenges like high energy costs.

By the end of 2025, the Tata Steel share price is expected to be around ₹170 in normal conditions. In a bear market, it might be ₹160, and in a bull market, it may cross its 52-week high of ₹185.

| Tata Steel Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 160 |

| 2nd Target | 170 |

| 3rd Target | 185 |

In 2026, the Tata Steel share price is expected to be around ₹195 in a normal situation. In a bear market, it might be ₹180, and in a bull market, it may cross ₹215.

| Tata Steel Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 180 |

| 2nd Target | 195 |

| 3rd Target | 215 |

According to our analysis, the Tata Steel share price is expected to be around ₹235 in 2027. In a bear market, it might be ₹200, and in a bull market, it may cross ₹260.

| Tata Steel Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 200 |

| 2nd Target | 235 |

| 3rd Target | 260 |

According to our analysis, the Tata Steel share price may trade near ₹240 by 2028; bearish conditions could pull it down to ₹225, while a strong bull run might lift it to ₹275.

| Tata Steel Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 225 |

| 2nd Target | 240 |

| 3rd Target | 275 |

In a normal situation, the Tata Steel share price is projected to be approximately ₹265 in 2029. In a bear market, the value may be as low as ₹250, while in a bull market, it may rise to ₹305.

| Tata Steel Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 250 |

| 2nd Target | 265 |

| 3rd Target | 305 |

By 2030, the Tata Steel share price is projected to be around ₹320 under normal conditions. In adverse markets, the price could fall to ₹300, while favorable conditions might push it up to ₹350.

| Tata Steel Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 300 |

| 2nd Target | 320 |

| 3rd Target | 350 |

By 2035, the Tata Steel share price is projected to be around ₹775 under normal conditions. In adverse markets, the price could fall to ₹700, while favorable conditions might push it up to ₹900.

| Tata Steel Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 700 |

| 2nd Target | 775 |

| 3rd Target | 900 |

Under normal conditions, the Tata Steel share price might hit ₹1800 by 2040. A bearish trend could lower it to ₹1400, whereas a bullish surge could raise it to ₹2700.

| Tata Steel Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 1400 |

| 2nd Target | 1800 |

| 3rd Target | 2700 |

In 2050, the Tata Steel share price is expected to be around ₹8200 in a normal situation. In a bear market, it might be ₹7000, and in a bull market, it may go up to ₹10,000.

| Tata Steel Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 7000 |

| 2nd Target | 8200 |

| 3rd Target | 10,000 |

| Years | Target Price |

|---|---|

| Tata Steel Share Price Target 2025 | ₹ 160 to 185 |

| Tata Steel Share Price Target 2026 | ₹ 180 to 215 |

| Tata Steel Share Price Target 2027 | ₹ 200 to 260 |

| Tata Steel Share Price Target 2028 | ₹ 225 to 275 |

| Tata Steel Share Price Target 2029 | ₹ 250 to 305 |

| Tata Steel Share Price Target 2030 | ₹ 300 to 350 |

| Tata Steel Share Price Target 2035 | ₹ 700 to 900 |

| Tata Steel Share Price Target 2040 | ₹ 1400 to 2700 |

| Tata Steel Share Price Target 2050 | ₹ 7000 to 10000 |

Tata Steel Latest Earnings

Tata Steel reported a consolidated net profit of ₹295 crore in Q3 2025, a 43% decrease YoY from ₹522 crore and a 61% drop QoQ from ₹759 crore. Consolidated revenue stood at ₹53,648 crore, down 3% YoY and 0.5% QoQ. The company reduced its net debt by approximately ₹3,000 crore QoQ to ₹85,800 crore and invested ₹3,868 crore in capital expenditure during the quarter.

Conclusion

Tata Steel has good growth potential, thanks to its focus on sustainability, expanding production, and using new technology. With a strong presence in both India and around the world, the company is set to meet the increasing demand for steel in many industries. However, it faces challenges like rising costs, raw material price changes, and global market risks. Despite these challenges, Tata Steel remains a strong company and could be a good option for long-term investments.

FAQ’s

Can Tata Steel deliver good returns by 2030?

Yes, based on current growth trends and strategic plans, Tata Steel’s share price may reach around ₹320 by 2030. In favorable conditions, it could go as high as ₹350.

What are the key growth drivers for Tata Steel in the long term?

Tata Steel’s key growth drivers include capacity expansion in India, strategic partnerships, increasing domestic and international demand, government support for infrastructure, and a focus on value-added steel products.

Is Tata Steel a good long-term investment?

Tata Steel has a strong global presence, a diverse product portfolio, and long-term growth strategies. However, investors should also consider risks such as debt levels, foreign losses, and valuation issues.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: Tata Motors Share Price Target 2025 to 2050