Tata Motors is one of the most popular stocks in the Indian stock market. It was listed on the National Stock Exchange (NSE) on July 22, 1998. In the last five years, its stock gave a massive return of more than 350%. Will Tata Motors continue to provide such impressive returns in 2025 and future years as well? In this article, we will explore Tata Motors’ growth potential and Tata Motors share price target 2025 to 2050.

About Tata Motors

Tata Motors was founded by J.R.D. Tata in 1945. It is one of India’s largest automobile companies and a part of the prestigious Tata Group. Initially established to manufacture locomotives, it later expanded to manufacture a wide range of vehicles, including cars, trucks, buses, and SUVs, serving both domestic and international markets. Tata Motors is well known for its innovation and build quality. It owns popular global brands like Jaguar and Land Rover.

Tata Motors Fundamental Analysis

| Stock Name | Tata Motors |

|---|---|

| NSE Symbol | TATAMOTORS |

| Market Cap | ₹ 2,37,171 Cr. |

| 52W High | ₹ 1179 |

| 52W Low | ₹ 536 |

| Stock P/E (TTM) | 7.45 |

| Book Value | ₹ 275 |

| Dividend Yield | 0.47 % |

| ROCE | 20.1 % |

| ROE | 49.4 % |

| Face Value | ₹2.00 |

| Industry PE | 21.5 |

| Price to book value | 2.35 |

| Debt to equity | 1.05 |

| PEG Ratio | 0.08 |

| Quick ratio | 0.63 |

| Shareholder | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 46.39% | 46.36% | 42.58% |

| FIIs | 15.34% | 19.20% | 17.84% |

| DIIs | 17.69% | 16.01% | 16.88% |

| Government | 0.14% | 0.14% | 0.31% |

| Public | 20.41% | 18.31% | 22.39% |

| No. of Shareholders | 38,14,831 | 46,16,908 | 67,28,246 |

Key Factors Driving Tata Motors’ Future Growth

- Focus on EV: Tata Motors is actively expanding its electric vehicle (EV) lineup, with plans to introduce models such as the Tata Harrier EV, Tata Avinya EV, and Tata Sierra EV in 2025. This strategic move aims to capture a significant share of the growing EV market.

- Strategic Business Restructuring: Tata Motors plans to separate its Passenger Vehicle (PV) and Commercial Vehicle (CV) businesses into two independent listed entities within the next 12-15 months. This move aims to unlock value, streamline operations, and enable more focused strategies for each business segment.

Pros of Investing in Tata Motors

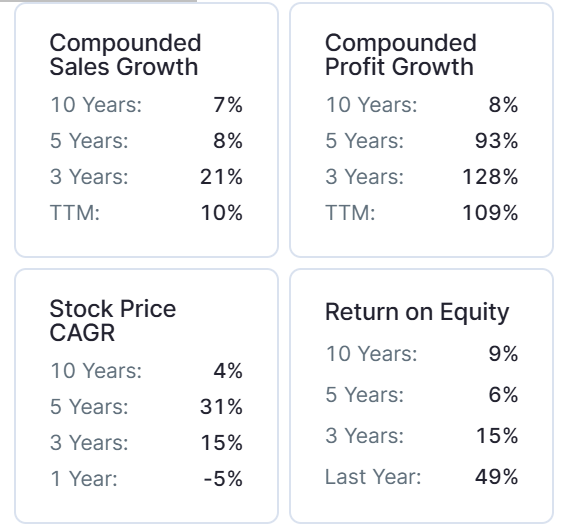

- Strong Sales Growth: Tata Motors’ sales have grown at a 21% CAGR over the last three years.

- Strong Profit Growth: Tata Motors’ profits have grown at 128% CAGR over the last three years.

- Attractive Valuation: Tata Motors’ stock is currently trading at a PE ratio of 7.45, indicating a fair valuation compared to its earnings.

- Strong Market Presence: Tata Motors is a market leader in India and has a significant global presence through Jaguar and Land Rover.

- Electric Vehicle (EV) Leadership: The company is investing heavily in EVs, a rapidly growing market, which positions it well for future growth.

- Diverse Product Portfolio: Tata Motors manufactures a wide range of vehicles, including passenger cars, commercial vehicles, and luxury automobiles.

- Backed by the Tata Group: Tata Motors is part of one of India’s most trusted Tata Group, which ensures its financial stability and credibility.

- Global Expansion: The company is increasing its focus on international markets, which can lead to exponential revenue growth.

- Government Initiatives: Tata Motors will benefit from Indian government policies that promote EV adoption and domestic manufacturing in India.

- Increase in DIIs Holding: DIIs holding increased from 16.54% in December 2024 to 16.88% in March 2025, showing a positive outlook towards Tata Motors by the DIIs.

Cons of Investing in Tata Motors

- Low Return on Equity (ROE): Tata Motors’ 5-year average ROE is 5.82%, which shows that it is not using shareholders’ funds efficiently to generate profits.

- Low Return on Capital Employed (ROCE): Tata Motors’ 5-year average ROCE is 6.64%, which shows that it is not using its capital efficiently to generate profits.

- High Financial Risk: Tata Motors has a high debt-to-equity ratio of 1.05, indicating a strong dependency on debt. This increases financial risk, raises interest costs, and may have an impact on profitability.

- Volatility in Jaguar and Land Rover: Tata Motors’ dependency on its luxury brand makes it vulnerable to global economic slowdowns and geopolitical risks.

- Intense Competition: The company faces strong competition from global and domestic players in both passenger and commercial vehicle segments.

- Cyclic Business: Automobile demand is cyclical and depends heavily on economic conditions, which can affect sales and profits.

- Rising Costs: Increasing raw material prices and investment in EV technology can affect margins.

- Regulatory Challenges: Changes in emission norms and safety standards may incur additional costs.

- Decrease in FIIs Holding: Foreign Institutional Investors (FIIs) have reduced their holding to 17.84% in March 2025 from 18.66% in December 2024, indicating a decline in FII’s confidence in the company’s future growth prospects.

By the end of 2025, the Tata Motors share price is expected to be around ₹925 in normal conditions. In a bear market, it might be ₹800, and in a bull market, it may cross its 52-week high of ₹1050.

| Tata Motors Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 800 |

| 2nd Target | 925 |

| 3rd Target | 1050 |

In 2026, the Tata Motors share price is expected to be around ₹1150 in a normal situation. In a bear market, it might be ₹960, and in a bull market, it may cross ₹1360.

| Tata Motors Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 960 |

| 2nd Target | 1150 |

| 3rd Target | 1360 |

According to our analysis, the Tata Motors share price is expected to be around ₹1300 in 2027. In a bear market, it might be ₹1150, and in a bull market, it may cross ₹1750.

| Tata Motors Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 1150 |

| 2nd Target | 1300 |

| 3rd Target | 1750 |

According to our analysis, the Tata Steel share price may trade near ₹1650 by 2028; bearish conditions could pull it down to ₹1400, while a strong bull run might lift it to ₹2300.

| Tata Motors Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 1400 |

| 2nd Target | 1650 |

| 3rd Target | 2300 |

In a normal situation, the Tata Motors share price is projected to be approximately ₹2100 in 2029. In a bear market, the value may be as low as ₹1650, while in a bull market, it may rise to ₹2950.

| Tata Motors Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 1650 |

| 2nd Target | 2100 |

| 3rd Target | 2950 |

In a normal situation, the Tata Motors share price is projected to be approximately ₹2500 in 2030. In a bear market, the value may be as low as ₹2000, while in a bull market, it may rise to ₹3500.

| Tata Motors Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 2000 |

| 2nd Target | 2500 |

| 3rd Target | 3500 |

By 2035, the Tata Motors share price is projected to be around ₹6000 under normal conditions. In adverse markets, the price could fall to ₹4500, while favorable conditions might push it up to ₹10,000.

| Tata Motors Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 4500 |

| 2nd Target | 6000 |

| 3rd Target | 10,000 |

Under normal conditions, the Tata Motors share price might hit ₹15,000 by 2040. A bearish trend could lower it to ₹11,000, whereas a bullish surge could raise it to ₹30,000.

| Tata Motors Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 11,000 |

| 2nd Target | 15,000 |

| 3rd Target | 30,000 |

In 2050, the Tata Motors share price is expected to be around ₹45,000 in a normal situation. In a bear market, it might be ₹35,000, and in a bull market, it may go up to ₹1,20,000.

| Tata Motors Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 35,000 |

| 2nd Target | 45,000 |

| 3rd Target | 1,20,000 |

Tata Motors Ltd. Balance Sheet

| Particulrs | March 2023 | March 2024 | Sept 2024 |

|---|---|---|---|

| Equity Capital | 766 | 766 | 736 |

| Reserves | 44,556 | 84,152 | 100,326 |

| Borrowings | 134,113 | 107,262 | 106,549 |

| Other Liabilities | 155,239 | 177,340 | 183,045 |

| Total Liabilities | 334,674 | 369,521 | 390,656 |

| Fixed Assets | 132,080 | 121,285 | 157,718 |

| CWIP | 14,274 | 35,698 | 15,526 |

| Investments | 26,379 | 22,971 | 33,381 |

| Other Assets | 161,941 | 189,566 | 184,031 |

| Total Assets | 334,674 | 369,521 | 390,656 |

| Years | Target Price |

|---|---|

| Tata Motors Share Price Target 2025 | ₹ 800 to 1050 |

| Tata Motors Share Price Target 2026 | ₹ 960 to 1360 |

| Tata Motors Share Price Target 2027 | ₹ 1150 to 1750 |

| Tata Motors Share Price Target 2028 | ₹ 1400 to 2300 |

| Tata Motors Share Price Target 2029 | ₹ 1650 to 2950 |

| Tata Motors Share Price Target 2030 | ₹ 2000 to 3500 |

| Tata Motors Share Price Target 2035 | ₹ 4500 to 10,000 |

| Tata Motors Share Price Target 2040 | ₹ 11,000 to 30,000 |

| Tata Motors Share Price Target 2050 | ₹ 35,000 to 1,20,000 |

Conclusion

Tata Motors‘ future looks promising due to India’s growing electric vehicle segment. Tata Motors has a strong market position and a diverse product portfolio. Despite challenges such as high debt and market competition, Tata Motors can be a great pick for long-term investments.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: ITC Price Target 2025 to 2050