Suzlon Energy Ltd. was listed on the NSE on October 19, 2005. In the last five years, it gave a massive return of more than 1800%. Will Suzlon continue to provide such impressive returns in 2025 and future years as well? In this article, we will explore the Suzlon Energy’s growth potential and Suzlon share price target from 2025 to 2050.

About Suzlon Energy

Suzlon Energy is a leading renewable energy company in India that manufactures wind turbines and offers sustainable energy solutions. Suzlon Energy was founded in 1995. It has played a crucial role in advancing wind power in India and around the world. The company is known for its wind resource assessment, turbine manufacturing, installation, and maintenance.

Suzlon Business Model

- Renewable Energy Solutions and Manufacturing: Suzlon Energy is a leading renewable energy company that specialises in wind turbine manufacturing and integrated wind energy solutions. The company designs, develops, and installs wind turbines and provides various services such as wind resource assessment, engineering, and project management. Suzlon works with utility-scale projects, independent power producers, and corporate clients looking for sustainable energy solutions.

- Operations and Maintenance Services: Suzlon offers long-term operations and maintenance (O&M) services to ensure the best performance and efficiency from installed wind turbines. This segment generates recurring revenue by providing clients with predictive maintenance, remote monitoring, and performance upgrades, ensuring maximum energy output and ROI.

- Project Development and Wind Farm Management: Beyond manufacturing, Suzlon is involved in project development, managing the entire wind farm lifecycle from site identification to commissioning. The company also owns and operates wind farms, which generate revenue from power purchase agreements (PPAs) and direct energy sales to utilities and industries.

Suzlon Energy Fundamental Analysis

| Stock Name | Suzlon Energy Ltd. |

|---|---|

| Market Cap | ₹ 74,555 Cr. |

| 52W High | ₹ 86.0 |

| 52W Low | ₹ 37.9 |

| Stock P/E (TTM) | 63.7 |

| Book Value | ₹ 3.32 |

| Dividend Yield | 0 % |

| ROCE | 24.9 % |

| ROE | 28.8 % |

| Face Value | ₹ 2 |

| Share holder | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 13.28% | 13.26% | 13.25% |

| FIIs | 19.57% | 21.53% | 23.04% |

| DIIs | 6.30% | 9.16% | 8.73% |

| Government | 0.00% | 0.00% | 0.00% |

| Public | 60.85% | 56.03% | 54.98% |

Key Factors Driving Suzlon Future Growth

- Government Policies and Renewable Push: Suzlon benefits from favourable government policies that promote wind energy, such as Production Linked Incentives (PLI) and Renewable Purchase Obligations.

- Expansion of Manufacturing Capacity: Suzlon Energy plans to increase its annual wind turbine production capacity from 3.5 GW to 5 GW, which includes investments of ₹350–400 crore in new blade manufacturing lines in Madhya Pradesh and Rajasthan.

- Technological Advancements and R&D Focus: Suzlon continues to innovate by developing larger, more efficient wind turbines for low-wind regions, opening up market opportunities in India and worldwide. The introduction of its 3 MW series turbines, each with a Hybrid Lattice Tubular (HLT) tower and a rated capacity of 3.15 MW, shows this focus by increasing energy yield and lowering energy generation costs.

Pros of Suzlon Energy

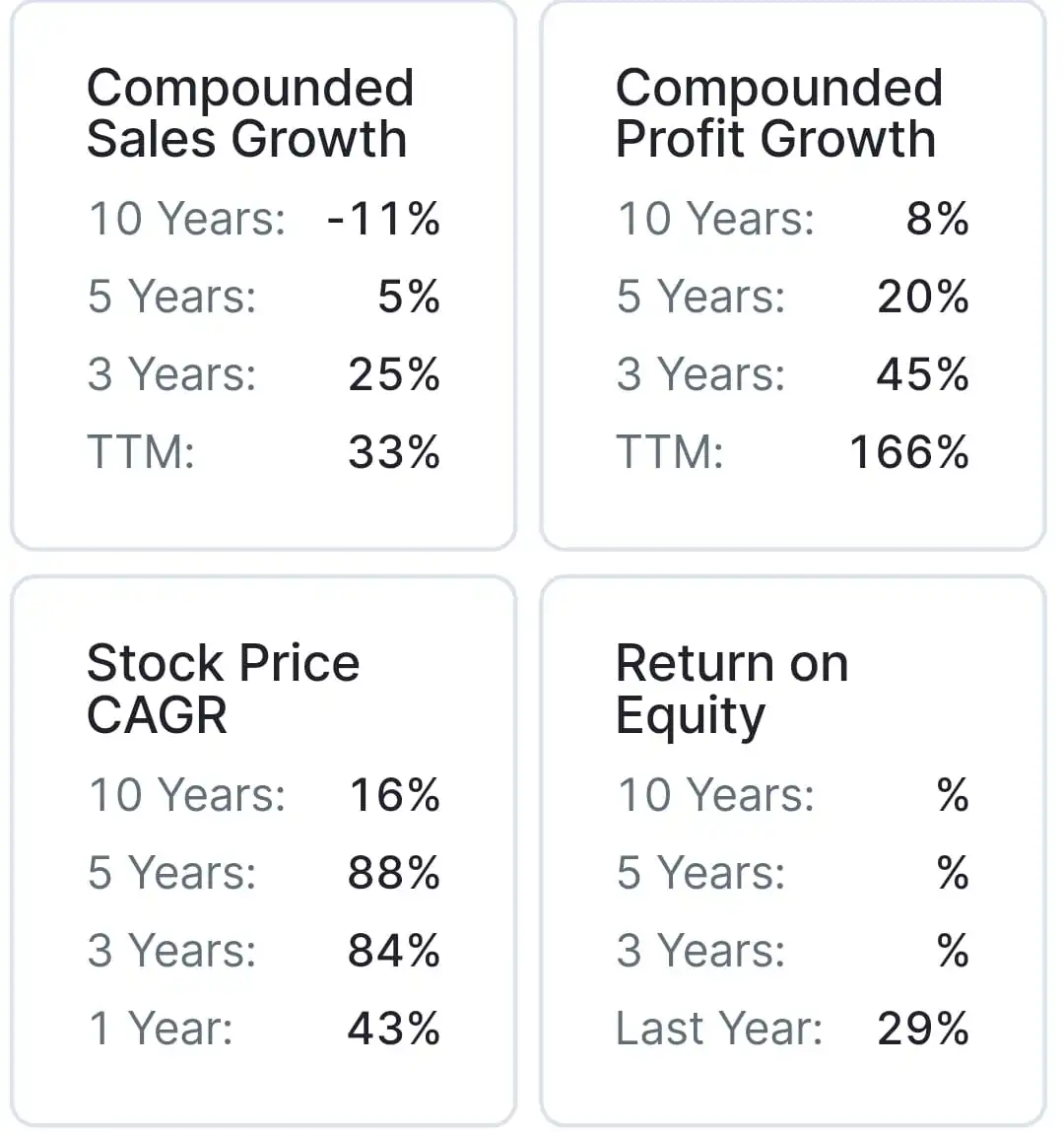

- Strong Sales Growth: Suzlon Energy’s sales have grown at 25% CAGR over the last 3 years.

- Strong Profit Growth: Suzlon Energy’s profits have grown at 45% CAGR over the last 3 years.

- Debt Free Company: Suzlon Energy is an almost debt-free company with a debt to equity ratio of 0.06, which shows its financial stability.

- Increase in FIIs Holding: Foreign Institutional Investors (FIIs) have increased their holding from 22.87% in December 2024 to 23.04% in March 2025, which indicates growing confidence in Suzlon’s future potential by the FIIs.

Cons of Suzlon Energy

- Low Return on Capital Employed (ROCE): Suzlon Energy’s 5-year average ROCE is 5.64%, which shows that the company is not using its capital efficiently to generate profits.

- Overvaluation Concern: Suzlon Energy’s stock is trading at a PE ratio of 63.7 and a (P/B) ratio of 16.6, which shows that its stock is significantly overvalued compared to its earnings and assets.

- Low Promoter Holding: Suzlon Energy’s promoter holding is 13.2%, which is relatively low. This may indicate low promoter confidence and less control over decision-making, allowing outside investors to have more influence.

- Decrease in DIIs Holding: Domestic Institutional Investors (DIIs) have reduced their holding from 9.31% in December 2024 to 8.73% in March 2025, indicating a decline in DIIs’ confidence in the company’s future growth prospects.

Suzlon Energy has a record-high order book of 5.5 GW, which provides strong revenue visibility for 2025 and the upcoming years as well. In 2025, Suzlon’s share price target would be ₹85, as per our analysis.

According to our prediction, Suzlon share price would be between ₹70 to ₹85 in 2025.

| Suzlon Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 70 |

| 2nd Target | 76 |

| 3rd Target | 85 |

In the last 5 years, Suzlon’s profit has grown at a CAGR of 20%. If its profit continues to grow like this, then its stock price will reach a much higher level in the next 5 years. By 2030, Suzlon’s share price target would be ₹315, as per our analysis.

According to our prediction, the Suzlon share price would be between ₹175 to ₹315 in 2030.

| Suzlon Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 175 |

| 2nd Target | 240 |

| 3rd Target | 315 |

By 2035, if Suzlon becomes a major player in solar and wind energy, its stock may reach ₹675 in a normal case. The bear case could be ₹350, and in the bull case, Suzlon’s stock price might go up to ₹950, as per our analysis.

| Suzlon Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 350 |

| 2nd Target | 675 |

| 3rd Target | 950 |

By 2040, with consistent performance and expansion, Suzlon could trade around ₹1950. In the bear case, it may be ₹700, while in the bull case, it might cross ₹2,800, as per our analysis.

| Suzlon Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 700 |

| 2nd Target | 1950 |

| 3rd Target | 2800 |

By 2050, if India reaches its zero carbon emission goal and Suzlon plays a major role in it, then Suzlon’s stock price may reach ₹5,500 in a normal case. The bear case could be ₹3,000, and the bull case might go up to ₹17,000, according to our analysis.

| Suzlon Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 3000 |

| 2nd Target | 5500 |

| 3rd Target | 17000 |

| Years | Target Price |

|---|---|

| Suzlon Energy Share Price Target 2025 | ₹70 to ₹85 |

| Suzlon Energy Share Price Target 2026 | ₹82 to ₹110 |

| Suzlon Energy Share Price Target 2027 | ₹100 to ₹145 |

| Suzlon Energy Share Price Target 2028 | ₹122 to ₹185 |

| Suzlon Energy Share Price Target 2029 | ₹145 to ₹245 |

| Suzlon Energy Share Price Target 2030 | ₹175 to ₹315 |

| Suzlon Energy Share Price Target 2035 | ₹350 to ₹950 |

| Suzlon Energy Share Price Target 2040 | ₹700 to ₹2800 |

| Suzlon Energy Share Price Target 2050 | ₹3000 to ₹17000 |

Conclusion

Suzlon Energy’s future looks promising, thanks to India’s aggressive push for renewable energy and the company’s leadership in the wind energy sector. Suzlon stands to benefit from favourable government policies, increased wind capacity installations, and rising interest in hybrid wind-solar projects. While market conditions and share prices can fluctuate, Suzlon’s strong pipeline of projects and technological advancements position it as a strong candidate for long-term investment in renewable energy.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: WPIL Share Price Target 2025 to 2050