Praj Industries Ltd. was listed on the BSE on October 11, 1995. In the last five years, its stock gave a massive return of more than 630% to its investors. Will Praj Industries continue to provide such impressive returns in the future years as well? In this article, we will explore the Praj Industries’ growth potential and the Praj Industries share price target 2025 to 2050.

About Praj Industries

Praj Industries was established in 1983. It focuses on delivering engineering solutions for bioenergy, water treatment, and environmental sustainability. The company provides goods and services for ethanol plants, gas generation, and waste-to-energy projects. Praj Industries has developed to become a clean energy solutions leader in India and around the world.

Praj Industries Business Model

- Bioenergy Solutions: Praj Industries provides bioenergy solutions, including waste-to-energy initiatives, biogas plants, and ethanol production facilities. They design and build plants to help in the energy conversion of biomass, agricultural waste, and other organic resources.

- Water and Wastewater Treatment: Praj Industries provides services for the treatment of water and wastewater. They support towns and businesses in their efforts to recycle and treat water, which is essential to sustainable development.

- Engineering Services: Praj offers engineering services for the development of industrial facilities, especially in the fields of environmental and bioenergy. They provide design, construction, and project management services.

- Equipment and Product Sales: Praj provides specialist equipment such as processing tanks, evaporation columns, and filtration systems for bioenergy and water treatment plants. This is a significant source of revenue for the organization.

Praj Industries Fundamental Analysis

| Stock Name | Praj Industries Ltd. |

|---|---|

| NSE Symbol | PRAJIND |

| Market Cap | ₹ 8278 Cr. |

| 52W High | ₹ 875 |

| 52W Low | ₹ 446 |

| Stock P/E (TTM) | 41.4 |

| Book Value | ₹ 75.2 |

| Dividend Yield | 1.32 % |

| ROCE | 19.2 % |

| ROE | 15.0 % |

| Face Value | ₹ 2.00 |

| Industry PE | 35.1 |

| Price to book value | 5.99 |

| Debt to equity | 0.14 |

| PEG Ratio | 1.68 |

| Quick ratio | 1.36 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 32.82% | 32.81% | 32.81% |

| FIIs | 17.83% | 18.87% | 18.63% |

| DIIs | 7.83% | 13.69% | 18.19% |

| Public | 41.50% | 34.64% | 30.38% |

| No. of Shareholders | 2,83,459 | 3,24,849 | 3,53,099 |

Key Factors Driving Praj Industries’ Future Growth

- Strong Focus on Sustainability: Praj Industries is committed to environmentally friendly solutions such as waste-to-energy conversion, wastewater treatment, and bioenergy. Praj Industries is in a good position to profit from the rising demand for green solutions as more governments and enterprises push for eco-friendly practices.

- Growing International Presence: Praj Industries is growing its business abroad. Praj Industries is meeting the demand for bioenergy, water treatment, and engineering services technology worldwide by expanding its business outside India.

- Growing bioenergy market: With the global move toward renewable energy, Praj Industries’ expertise in bioenergy solutions, such as ethanol and biogas generation, is a critical driver of future growth. As more countries focus on decreasing carbon emissions, Praj Industries’ solutions will continue to experience increased demand.

- Strategic Partnerships and Alliances: Praj Industries has created collaborations with major companies such as Indian Oil Corporation to build ethanol facilities. These collaborations enable Praj to enter new markets, share resources, and increase its skills, resulting in long-term success.

Pros of Investing in Praj Industries

- Leader in Bioenergy: Praj Industries is a strong player in the bioenergy field, especially in making ethanol. This position helps the company grow as the demand for biofuels increases.

- Multiple Sources of Income: Praj Industries earns from different areas like bioenergy, water treatment, and equipment for industries. This reduces risk because the company isn’t depending on just one business.

- Global Reach: Praj operates in over 75 countries, which helps the company grow by reaching new markets and reducing dependency on any single country’s economy.

- Focus on Green Energy: Praj is committed to making technologies that are good for the environment, like biofuels and wastewater treatment. This aligns with global efforts to fight climate change and creates more opportunities.

- Strong Partnerships: Praj works with big companies like Indian Oil to build ethanol plants. These partnerships help Praj grow and expand its capabilities.

- Investment in Innovation: Praj regularly invests in research and development to improve its technologies. This ensures the company stays ahead of the competition and continues to offer better solutions.

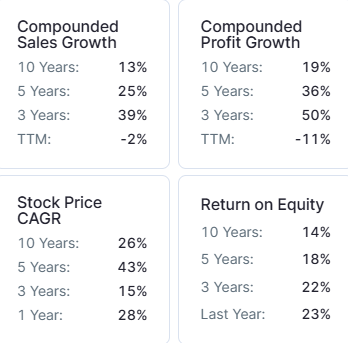

- Strong Sales Growth: Praj Industries’ sales have grown at a 24% CAGR over the last five years.

- Strong Profit Growth: Praj Industries’ profits have grown at a 25% CAGR over the last five years.

- High Return on Capital Employed (ROCE): Praj Industries’ 5yrs average ROCE is 23.5%, which shows that it is utilizing its capital effectively to generate profits.

- Low Debt Levels: Praj Industries debt to equity ratio is 0.14, which indicates that the company is less dependent on debt, which reduces its financial risk.

Cons of Investing in Praj Industries

- Price Fluctuations: Praj Industries’ stock price has been bouncing up and down a lot, with a big difference between its highest and lowest price over the past year. This can be risky if you’re looking for a stable investment.

- Reliance on Government Rules: Praj Industries works in areas like bioenergy and water treatment, which depend a lot on government rules and policies. Any change in these rules could affect the company’s profits and operations.

- Overvaluation Concern: Praj Industries’ stock is trading at a PE ratio of 41.4 and a (P/B) ratio of 5.99, which shows that its stock is significantly overvalued compared to its earnings and assets.

- Low Promoter Holding: Praj Industries’ promoter holding is 32.8%, which is relatively low. This may indicate low promoter confidence and less control over decision-making, allowing outside investors to have more influence.

Praj Industries Ltd Balance Sheet

| Particulars | March 2024 | March 2025 |

|---|---|---|

| Equity Capital | 37 | 37 |

| Reserves | 1,238 | 1,345 |

| Borrowings | 169 | 195 |

| Other Liabilities | 1,450 | 1,584 |

| Total Liabilities | 2,894 | 3,160 |

| Fixed Assets | 474 | 568 |

| CWIP | 43 | 17 |

| Investments | 497 | 428 |

| Other Assets | 1,880 | 2,147 |

| Total Assets | 2,894 | 3,160 |

By the end of 2025, the Praj Industries share price is expected to be around ₹600 in normal conditions. In a bear market, it might be ₹560, and in a bull market, it may go up to ₹700.

| Praj Industries Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 560 |

| 2nd Target | 600 |

| 3rd Target | 700 |

In 2026, the Praj Industries share price is expected to be around ₹720 in a normal situation. In a bear market, it might be ₹670, and in a bull market, it may cross ₹910.

| Praj Industries Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 670 |

| 2nd Target | 720 |

| 3rd Target | 910 |

According to our analysis, the Praj Industries share price is expected to be around ₹890 in 2027. In a bear market, it might be ₹810, and in a bull market, it may cross ₹1180.

| Praj Industries Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 810 |

| 2nd Target | 890 |

| 3rd Target | 1180 |

According to our analysis, the Praj Industries share price may trade near ₹1150 by 2028; bearish conditions could pull it down to ₹970, while a strong bull run might lift it to ₹1530.

| Praj Industries Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 970 |

| 2nd Target | 1150 |

| 3rd Target | 1530 |

In a normal situation, the Praj Industries share price is projected to be approximately ₹1250 in 2029. In a bear market, the value may be as low as ₹1160, while in a bull market, it may rise to ₹1990.

| Praj Industries Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 1160 |

| 2nd Target | 1250 |

| 3rd Target | 1990 |

In a normal situation, the Praj Industries share price is projected to be approximately ₹1550 in 2030. In a bear market, the value may be as low as ₹1390, while in a bull market, it may rise to ₹2590.

| Praj Industries Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 1390 |

| 2nd Target | 1550 |

| 3rd Target | 2590 |

By 2035, the Praj Industries share price is projected to be around ₹4000 under normal conditions. In adverse markets, the price could fall to ₹2800, while favorable conditions might push it up to ₹7770.

| Praj Industries Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 2800 |

| 2nd Target | 4000 |

| 3rd Target | 7770 |

Under normal conditions, the Praj Industries share price might hit ₹6500 by 2040. A bearish trend could lower it to ₹5670, whereas a bullish surge could raise it to ₹23310.

| Praj Industries Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 5670 |

| 2nd Target | 6500 |

| 3rd Target | 23310 |

In 2050, the Praj Industries share price is expected to be around ₹25500 in a normal situation. In a bear market, it might be ₹22300, and in a bull market, it may go up to ₹139850.

| Praj Industries Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 22300 |

| 2nd Target | 25500 |

| 3rd Target | 139850 |

| Years | Target Price |

|---|---|

| Praj Industries Share Price Target 2025 | ₹ 560 to 700 |

| Praj Industries Share Price Target 2026 | ₹ 670 to 910 |

| Praj Industries Share Price Target 2027 | ₹ 810 to 1180 |

| Praj Industries Share Price Target 2028 | ₹ 970 to 1530 |

| Praj Industries Share Price Target 2029 | ₹ 1160 to 1990 |

| Praj Industries Share Price Target 2030 | ₹ 1390 to 2590 |

| Praj Industries Share Price Target 2035 | ₹ 2800 to 7770 |

| Praj Industries Share Price Target 2040 | ₹ 5670 to 23310 |

| Praj Industries Share Price Target 2050 | ₹ 22300 to 139850 |

Conclusion

Praj Industries is a strong company that focuses on renewable energy, water treatment, and sustainable solutions. It has a good market position and is expanding globally, which is great for future growth. However, investors should be cautious because the profit has recently gone down, and the company depends on government rules. Even with these risks, Praj’s focus on innovation and green energy gives it good potential for growth. It’s important to carefully consider both the positives and negatives before investing in Praj Industries.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.