HAL’s was listed on the NSE and BSE on March 28, 2018. In the last five years, its stock has given a massive return of more than 1760% to its investors. Will HAL’s continue to provide such great returns in the future as well? Let’s explore HAL’s growth potential and the HAL’s share price target 2025 to 2050 in this article.

About HAL

Hindustan Aeronautics Limited (HAL), an Indian aerospace and defence company, was founded in 1940. It designs, develops, and produces aircraft, helicopters, and other aerospace components for the Indian Armed Forces. HAL also offers upkeep, repairs, and a services for both military and civilian aircraft. HAL has contributed significantly to India’s defence sector over the years by producing fighter jets, transport aircraft, and advanced avionics.

HAL Business Model

- Aircraft Manufacturing: HAL earns money by manufacturing fighter jets, helicopters, and transport planes for the Indian Air Force, Navy, and other organisations.

- Aerospace Components: HAL supplies defence and space agencies with critical aircraft components such as engines, avionics, and other parts.

- Maintenance and Repair Services: HAL performs maintenance, repair, and upgrades on aircraft and helicopters to ensure their long-term capability.

- Exports: HAL generates revenue by exporting aircraft, spare parts, and aerospace technology to other countries.

- Partnerships and Collaborations: HAL collaborates with international defense companies to develop advanced aircraft and technology, resulting in revenue from joint ventures and contracts.

- Space Sector Contributions: HAL produces components for India’s space missions, earning money by supplying critical parts to ISRO and other space agencies.

HAL Fundamental Analysis

| Stock Name | Hindustan Aeronautics Limited |

|---|---|

| NSE Symbol | HAL |

| Market Cap | ₹ 3,24,891 Cr. |

| 52W High | ₹ 5675 |

| 52W Low | ₹ 3046 |

| Stock P/E | 38.9 |

| Book Value | ₹ 523 |

| Dividend Yield | 0.73 % |

| ROCE | 33.9 % |

| ROE | 26.1% |

| Face Value | ₹ 5.00 |

| Industry PE | 90.3 |

| Price to book value | 9.23 |

| Debt to equity | 0.00 |

| PEG Ratio | 15.9 |

| Quick ratio | 1.55 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 71.65% | 71.64% | 71.64% |

| FIIs | 9.07% | 12.42% | 12.08% |

| DIIs | 13.93% | 9.58% | 8.26% |

| Government | 0.00% | 0.00% | 0.04% |

| Public | 5.34% | 6.36% | 7.97% |

| No. of Shareholders | 3,58,317 | 7,14,091 | 13,52,377 |

Key Factors Driving HAL Future Growth

- Government Defence Orders: The Indian government continues to order fighter jets, helicopters, and other defence equipment, generating the majority of HAL’s revenue. As India’s defence budget increases, HAL’s business is expected to grow.

- Indigenous Aircraft Development: HAL is developing advanced aircraft such as the Tejas fighter jet and the AMCA. These projects will help HAL’s future growth as India seeks to reduce dependency on foreign defense equipment.

- Maintenance and upgrades: HAL not only manufactures aircraft but also maintains and upgrades older models. This ensures a consistent income because air forces require routine maintenance and advancement of their fleets.

- Helicopter Production Growth: HAL is developing and producing helicopters such as the Light Utility Helicopter (LUH) and Light Combat Helicopter (LCH). Increased demand for these helicopters will help HAL expand even further.

- Collaboration with the Private Sector: HAL is working with private companies to improve production efficiency. This will allow HAL to meet increasing demand faster and improve its capabilities.

- Advanced Technology and R&D: HAL invests in research and development to improve aircraft and defence systems. HAL will remain competitive in the future thanks to innovations in aviation and defence technology.

- Growing Aerospace Market: The demand for aircraft and defence equipment is increasing in India and around the world. This will benefit HAL as more countries seek reliable and cost-effective solutions.

- Government Policies and Make in India: The Indian government is promoting self-reliance in defence manufacturing. HAL, as a state-owned company, will benefit from this initiative through additional projects and funding.

- Partnerships with Global Companies: HAL is working with international defence firms to bring new technology and manufacturing expertise. These collaborations will enable HAL to expand its capabilities and improve product quality.

Pros of HAL

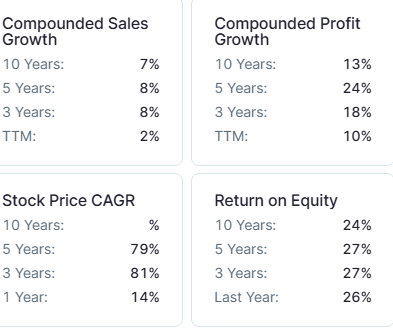

- Strong Profit Growth: HAL has achieved a strong profit growth of 33% CAGR over the last three years.

- High Return on Capital Employed (ROCE): HAL has maintained an average ROCE of 30% over the last five years, which shows that the HAL is using its capital efficiently to generate profit.

- High Return on Equity (ROE): HAL has maintained an average ROE of 26.6% over the last five years, which shows that the HAL is using shareholders funds efficiently to generate profits.

- Low PE Ratio Compared to Peers: HAL has a PE ratio of 26.4, which is lower than the industry average of 60.8, making it relatively undervalued and potentially a good investment opportunity.

- Debt Free Company: HAL is debt free company with a debt to equity ratio of 0, which shows its financial stability.

- High Promoter Holding: HAL has a strong promoter holding of 71.6%, indicating the promoters’ high confidence in the company’s future growth and stability.

- Increase in FIIs Holding: Foreign Institutional Investors (FIIs) have increased their holding to 12.26% in December 2024 from 11.85% in September 2024, which indicates growing confidence in the HAL future potential by the FIIs.

- Consistent Profit Growth: HAL profits have grown at a CAGR of 24% over the last five years.

- High Return on Capital Employed (ROCE): HAL 5yrs average ROCE is 32.0% which shows that it is utilizing its capital effectively to generate profits.

- High Return on Equity (ROE): HAL 5-year average ROE stands at 27.0%, indicating effective management and profitable operations.

- Low PE Ratio Compared to Peers: HAL PE ratio is 38.9, which is lower than the industry average of 90.3, making it relatively undervalued and potentially a good investment opportunity.

- Debt Free Company: HAL is almost a debt-free company with a debt-to-equity ratio of 0.00, which shows its financial stability.

- High Promoter Holding: HAL has a strong promoter holding of 71.6%, which shows the high confidence of promoters in the company’s future growth and stability.

- Increase in DIIs Holding: Domestic Institutional Investors (DIIs) have increased their holding to 8.26% in March 2025 from 8.13% in December 2024, which indicates growing confidence in the HAL future potential by the DIIs.

Cons of HAL

- High Price to Book Value: HAL is trading at a Price-to-Book Value (P/B) ratio of 9.23, which indicates that its stock is significantly overvalued compared to its book value.

- Decrease in FIIs Holding: Foreign Institutional Investors (FIIs) have reduced their holding to 12.08% in March 2025 from 12.26% in December 2024, indicating a decline in FII’s confidence in the company’s future growth prospects.

HAL Balance Sheet

| Particulars | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Equity Capital | 334 | 334 | 334 |

| Reserves | 23,238 | 28,804 | 34,647 |

| Borrowings | 52 | 50 | 1 |

| Other Liabilities | 45,652 | 51,723 | 71,284 |

| Total Liabilities | 69,276 | 80,911 | 106,267 |

| Fixed Assets | 6,834 | 6,737 | 8,677 |

| CWIP | 1,885 | 2,493 | 1,091 |

| Investments | 1,458 | 1,591 | 1,754 |

| Other Assets | 59,099 | 70,089 | 94,744 |

| Total Assets | 69,276 | 80,911 | 106,267 |

By the end of 2025, the HAL share price is expected to be around ₹6400 in normal conditions. In a bear market, it might be ₹6050, and in a bull market, it may go up to ₹7500.

| HAL Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 6050 |

| 2nd Target | 6400 |

| 3rd Target | 7500 |

In 2026, the HAL share price is expected to be around ₹8000 in a normal situation. In a bear market, it might be ₹7500, and in a bull market, it may cross ₹9800.

| HAL Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 7500 |

| 2nd Target | 8000 |

| 3rd Target | 9800 |

According to our analysis, the HAL share price is expected to be around ₹9000 in 2027. In a bear market, it might be ₹8750, and in a bull market, it may cross ₹12,700.

| HAL Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 8750 |

| 2nd Target | 9000 |

| 3rd Target | 12,700 |

According to our analysis, the HAL share price may trade near ₹12,500 by 2028; bearish conditions could pull it down to ₹10,500, while a strong bull run might lift it to ₹16,500.

| HAL Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 10,500 |

| 2nd Target | 12,500 |

| 3rd Target | 16,500 |

In a normal situation, the HAL share price is projected to be approximately ₹15,000 in 2029. In a bear market, the value may be as low as ₹12,600, while in a bull market, it may rise to ₹21,500.

| HAL Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 12,600 |

| 2nd Target | 15,000 |

| 3rd Target | 21,500 |

In a normal situation, the HAL share price is projected to be approximately ₹19,000 in 2030. In a bear market, the value may be as low as ₹15,000, while in a bull market, it may rise to ₹28,000.

| HAL Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 15,000 |

| 2nd Target | 19,000 |

| 3rd Target | 28,000 |

By 2035, the HAL share price is projected to be around ₹45,000 under normal conditions. In adverse markets, the price could fall to ₹30,000, while favorable conditions might push it up to ₹84,000.

| HAL Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 30,000 |

| 2nd Target | 45,000 |

| 3rd Target | 84,000 |

Under normal conditions, the Tata Steel share price might hit ₹1,00000 by 2040. A bearish trend could lower it to ₹60,000, whereas a bullish surge could raise it to ₹2,52,000.

| HAL Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 60,000 |

| 2nd Target | 1,00000 |

| 3rd Target | 2,52,000 |

In 2050, the HAL share price is expected to be around ₹5,50,000 in a normal situation. In a bear market, it might be ₹2,40,000, and in a bull market, it may go up to ₹15,12,000.

| HAL Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 2,40,000 |

| 2nd Target | 5,50,000 |

| 3rd Target | 15,12,000 |

| Years | Target Price |

|---|---|

| HAL Share Price Target 2025 | ₹6050 to ₹7500 |

| HAL Share Price Target 2026 | ₹7500 to ₹9800 |

| HAL Share Price Target 2027 | ₹8750 to ₹12,700 |

| HAL Share Price Target 2028 | ₹10,500 to ₹16,500 |

| HAL Share Price Target 2029 | ₹12,600 to ₹21,500 |

| HAL Share Price Target 2030 | ₹15,000 to ₹28,000 |

| HAL Share Price Target 2035 | ₹30,000 to ₹84,000 |

| HAL Share Price Target 2040 | ₹60,000 to ₹2,52,000 |

| HAL Share Price Target 2050 | ₹2,40,000 to ₹15,12,000 |

Conclusion

HAL has grown significantly over the last five years, delivering exceptional returns to its investors. HAL is well-positioned for future growth, thanks to strong government support, increased defence orders, and advances in indigenous aircraft development. Its focus on exports, maintenance services, and collaborations with private and global companies increases its future potential. Despite its high PB ratio, HAL’s debt-free status, strong profitability, and rising foreign investment indicate that investors believe in its long-term potential. For the latest updates, you can visit HAL official website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.