Central Depository Services Ltd. (CDSL) was listed on the NSE on June 30, 2017. In the last five years, its stock has given a massive return of more than 1000% to its investors. Will CDSL continue to provide such great returns in the future as well? Let’s explore CDSL’s growth potential and the CDSL share price target 2025 to 2050 in this article

About CDSL

Central Depository Services Limited (CDSL) is a company that helps people keep their stocks and bonds in a digital form, making it easy to buy and sell them. It was set up in 1999 and is one of the two main depositories in India, along with NSDL. CDSL helps investors, stock brokers, and companies manage their shares safely and efficiently. It improves the way people trade in the Indian stock market by making the process faster and more secure.

CDSL Business Model

- Fees for Holding Securities: CDSL makes money by charging investors and brokers a fee for holding their stocks and bonds in electronic form.

- Transaction Fees: Whenever an investor buys or sells securities, CDSL charges a small fee for processing these transactions.

- Annual Maintenance Fees: CDSL charges investors an annual fee for keeping their accounts and securities safe.

- Services for IPOs and Other Events: When companies issue new shares or pay dividends, CDSL charges fees for handling these activities for investors.

- Selling Data and Information: CDSL earns money by providing data and information about securities to financial institutions.

- Fees for Using Online Tools: CDSL charges investors and brokers for using its online systems and tools to trade and manage their securities.

CDSL Fundamental Analysis

| Stock Name | CDSL Ltd. |

|---|---|

| NSE Symbol | CDSL |

| Market Cap | ₹ 26961 Cr. |

| 52W High | ₹ 1,990 |

| 52W Low | ₹ 918 |

| Stock P/E | 51.2 |

| Book Value | ₹ 84.2 |

| Dividend Yield | 0.75 % |

| ROCE | 41.9 % |

| ROE | 32.6 % |

| Face Value | ₹ 10.0 |

| Industry PE | 55.6 |

| Price to book value | 15.3 |

| Debt to equity | 0.00 |

| PEG Ratio | 1.36 |

| Quick ratio | 3.48 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 20.00% | 15.00% | 15.00% |

| FIIs | 14.67% | 11.38% | 11.34% |

| DIIs | 18.48% | 23.15% | 15.41% |

| Public | 46.85% | 50.47% | 58.25% |

| No. of Shareholders | 8,28,853 | 8,34,101 | 15,29,589 |

Key Factors Driving CDSL’s Future Growth

- More People Opening Demat Accounts: As more people open demat accounts to hold their stocks electronically, CDSL will grow by providing its services.

- More People Investing in the Stock Market: As more people start investing in stocks, CDSL will get more business from the increasing number of transactions.

- Government Support for Digital Services: With the government’s push for digital finance, CDSL will grow as more trading and investing happen online.

- New Services Offered by CDSL: CDSL is adding new services like electronic voting and IPO handling. This will help attract more customers and increase its business.

- Popularity of Mutual Funds and ETFs: With more people investing in mutual funds and Exchange-Traded Funds (ETFs), CDSL will see more demand for its services to hold these investments electronically.

- Use of New Technology: CDSL is using new technology to make its services quicker and safer, which will help attract more customers.

- Increase in IPOs: As more companies list on the stock market through IPOs, CDSL will play a key role in managing these shares, bringing in more revenue.

Pros of Investing in CDSL

- Duopoly: CDSL and NSDL are the only companies in India that offer depository services. As a result, all the business in this sector is distributed between these two companies.

- Debt-Free Company: CDSL is almost a debt-free company, which means it is financially stable and can invest in its future growth without worrying about loans.

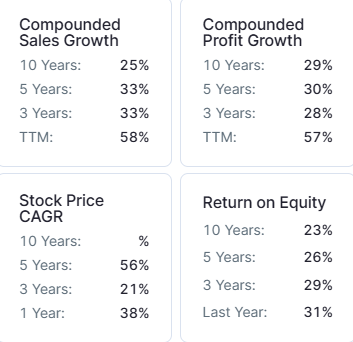

- Consistent Growth: CDSL has delivered good profit growth of 38% CAGR and good sales growth of 37% over the last 5 years.

- High ROCE and ROE: The company’s ROE is 31.3%, and its ROCE is 40.2%, reflecting the efficient use of funds to generate profits.

- High Operating Profit Margin: The operating profit margin of CDSL is around 60%, which is more than most of the companies in the Indian stock market.

Cons of Investing in CDSL

- Market Conditions Affect Business: CDSL’s business depends a lot on how the stock market is doing. If the market faces a downturn, CDSL’s earnings could drop too.

- Strong Competition: CDSL faces strong competition from NSDL in the same industry, which could affect its market share and growth.

- High Price to Book Value: CDSL is trading at a Price-to-Book Value (P/B) ratio of 15.3, which indicates that its stock is significantly overvalued compared to its book value.

- Low Promoter Holding: CDSL promoter holding is 15.0%, which is relatively low. This may indicate low promoter confidence and less control over decision-making, allowing outside investors to have more influence.

- Decrease in Institutional Confidence: DIIs have reduced their holding to 15.41% in March 2025 from 19.11% in December 2024 while FIIs have reduced their holding to 11.34% in March 2025 from 17.15% in December 2024, indicating a decline in institutional confidence in the company’s future growth prospects.

CDSL Ltd Balance Sheet

| Particulars | March 202 | March 2024 | Mar 2025 |

|---|---|---|---|

| Equity Capital | 104 | 104 | 209 |

| Reserves | 1,109 | 1,359 | 1,551 |

| Borrowings | 2 | 1 | 3 |

| Other Liabilities | 241 | 317 | 399 |

| Total Liabilities | 1,457 | 1,781 | 2,162 |

| Fixed Assets | 125 | 342 | 446 |

| CWIP | 174 | 4 | 7 |

| Investments | 937 | 1,149 | 1,351 |

| Other Assets | 221 | 287 | 357 |

| Total Assets | 1,457 | 1,781 | 2,162 |

By the end of 2025, the CDSL share price is expected to be around ₹1700 in normal conditions. In a bear market, it might be ₹1400, and in a bull market, it may cross its 52-week high of ₹2000.

| CDSL Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 1400 |

| 2nd Target | 1700 |

| 3rd Target | 2000 |

In 2026, the CDSL share price is expected to be around ₹2050 in a normal situation. In a bear market, it might be ₹1930, and in a bull market, it may cross ₹2600.

| CDSL Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 1930 |

| 2nd Target | 2050 |

| 3rd Target | 2600 |

According to our analysis, the CDSL share price is expected to be around ₹2650 in 2027. In a bear market, it might be ₹2320, and in a bull market, it may cross ₹3380.

| CDSL Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 2320 |

| 2nd Target | 2650 |

| 3rd Target | 3380 |

According to our analysis, the CDSL share price may trade near ₹2990 by 2028; bearish conditions could pull it down to ₹2780, while a strong bull run might lift it to ₹4090.

| CDSL Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 2780 |

| 2nd Target | 2990 |

| 3rd Target | 4090 |

In a normal situation, the CDSL share price is projected to be approximately ₹3950 in 2029. In a bear market, the value may be as low as ₹3840, while in a bull market, it may rise to ₹5710.

| CDSL Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 3840 |

| 2nd Target | 3950 |

| 3rd Target | 5710 |

In a normal situation, the CDSL share price is projected to be approximately ₹5500 in 2030. In a bear market, the value may be as low as ₹4010, while in a bull market, it may rise to ₹7420.

| CDSL Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 4010 |

| 2nd Target | 5500 |

| 3rd Target | 7420 |

By 2035, the CDSL share price is projected to be around ₹12500 under normal conditions. In adverse markets, the price could fall to ₹8020, while favorable conditions might push it up to ₹22270.

| CDSL Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 8020 |

| 2nd Target | 12500 |

| 3rd Target | 22270 |

Under normal conditions, the CDSL share price might hit ₹19500 by 2040. A bearish trend could lower it to ₹16040, whereas a bullish surge could raise it to ₹66820.

| CDSL Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 16040 |

| 2nd Target | 19500 |

| 3rd Target | 66820 |

In 2050, the CDSL share price is expected to be around ₹75000 in a normal situation. In a bear market, it might be ₹64100, and in a bull market, it may go up to ₹400000.

| CDSL Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 64100 |

| 2nd Target | 75000 |

| 3rd Target | 400000 |

| Years | Target Price |

|---|---|

| CDSL Share Price Target 2025 | ₹1400 to ₹2000 |

| CDSL Share Price Target 2026 | ₹1930 to ₹2600 |

| CDSL Share Price Target 2027 | ₹2320 to ₹3380 |

| CDSL Share Price Target 2028 | ₹2780 to ₹4090 |

| CDSL Share Price Target 2029 | ₹3840 to ₹5710 |

| CDSL Share Price Target 2030 | ₹4010 to ₹7420 |

| CDSL Share Price Target 2035 | ₹8020 to ₹22270 |

| CDSL Share Price Target 2040 | ₹16040 to ₹66820 |

| CDSL Share Price Target 2050 | ₹64100 to ₹400000 |

Conclusion

CDSL is an important company in India that helps manage stocks and bonds electronically. It has been doing well financially and has strong growth potential. However, there are some risks, like its high stock price, reliance on the stock market, and competition from other companies. While CDSL’s future looks good because more people are getting involved in the stock market, investors should think carefully about both the good and bad sides before deciding to invest. For more information, you can check the CDSL official website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: BEL Share Price Target 2025 to 2050