Castrol India is a part of Castrol Limited, which belongs to BP (British Petroleum). Since listing, its stock has given a massive return of around 530% to its investors. Will Castrol India continue to provide such impressive returns this year and in the future as well? In this article, we will explore Castrol India’s future growth potential and the Castrol India’s share price target 2025 to 2050.

About Castrol India

Castrol India makes oils and lubricants for vehicles and machines. It started in 1919 and has been in India for more than 100 years. Castrol India makes engine oils and other products for cars, bikes, trucks, and industries. Its products are available in many shops, workshops, and service centers across the country. The company focuses on making good quality oils to help engines run smoothly and last longer.

Castrol India Business Model

- Selling Engine Oils: Castrol makes and sells oils for cars, bikes, trucks, and other vehicles.

- Selling Industrial Oils: The company also makes special oils for machines used in factories and construction.

- Partnering with Car and Bike Companies: Many car and bike companies use Castrol oil in their vehicles, which helps the company sell more.

- Selling in Shops and Petrol Pumps: Castrol products are available in auto shops, petrol pumps, and garages across India.

- Selling to Service Centers: Many vehicle service centers use Castrol oil for servicing, which increases sales.

- Selling Online: People can buy Castrol oils from websites like Amazon and Flipkart.

- Exporting to Other Countries: Castrol India also sells its oils to other countries and earns money.

- Giving Brand License: The company allows other businesses to use the Castrol name under special agreements and earns money from it.

- Creating New Oils: Castrol keeps improving its oils, making them better for engines, which helps attract more customers.

Castrol India Fundamental Analysis

| Stock Name | Castrol India Ltd. |

|---|---|

| NSE Symbol | CASTROLIND |

| Market Cap | ₹ 19767 Cr. |

| 52W High | ₹ 284 |

| 52W Low | ₹ 163 |

| Stock P/E (TTM) | 20.9 |

| Book Value | ₹ 23.0 |

| Dividend Yield | 4.25 % |

| ROCE | 55.2 % |

| ROE | 41.8% |

| Face Value | ₹ 5.00 |

| Industry PE | 29.0 |

| Price to book value | 8.68 |

| Debt to equity | 0.04 |

| PEG Ratio | 9.78 |

| Quick ratio | 1.60 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 51.00% | 51.00% | 51.00% |

| FIIs | 11.44% | 9.51% | 10.64% |

| DIIs | 16.56% | 16.37% | 14.57% |

| Public | 20.99% | 23.11% | 23.79% |

| No. of Shareholders | 2,85,745 | 3,77,234 | 5,28,263 |

Key Factors Driving Castrol India Future Growth

- More Vehicles on the Road: As more people buy cars and bikes in India, the demand for Castrol India’s engine oils and lubricants will keep growing.

- Strong Brand and Trust: Castrol India is a well-known and trusted brand, which helps in getting more customers and staying ahead of competitors.

- Better and New Products: Castrol India is creating high-quality and advanced lubricants, including eco-friendly options and products for electric vehicles (EVs).

- Expansion in Small Towns and Villages: Castrol India is reaching more customers in rural areas, where vehicle use is increasing.

- Partnerships with Big Companies: Castrol India works with car and bike manufacturers, service centers, and workshops, ensuring steady sales.

- Online and Digital Growth: More people are buying Castrol India’s products online, making it easier to reach a larger audience.

- Support from Parent Company (BP): Castrol India benefits from BP’s financial strength, global experience, and advanced technology, helping in long-term growth.

Pros of Castrol India

- High Return on Capital Employed (ROCE): Castrol India has maintained an average ROCE of 59.4% over the last five years, which shows that the “Company Name” is using its capital efficiently to generate profit.

- High Return on Equity (ROE): Over the last five years, Castrol India has maintained an average ROE of 20%, which shows that Castrol India is using shareholders funds efficiently to generate profits.

- Low PE Ratio Compared to Peers: Castrol India has a PE ratio of 23.9, which is lower than industry average of 28.4, making it relatively undervalued and potentially a good investment opportunity.

- Debt Free Company: Castrol India is almost debt free company with a debt to equity ratio of 0.04, which shows its financial stability.

- High Return on Capital Employed (ROCE): Castrol India 5yrs average ROCE is 59.4% which shows that it is utilizing its capital effectively to generate profits.

- High Return on Equity (ROE): Castrol India 5-year average ROE is 44.2% which shows that the company is using its shareholders funds well to generate profits.

- Low PE Ratio Compared to Peers: Castrol India PE ratio is 20.9, which is lower than the industry average of 29.0, making it relatively undervalued and potentially a good investment opportunity.

- Debt Free Company: Castrol India is almost debt free company with a debt to equity ratio of 0.04, which shows its financial stability.

- Increase in Institutional Confidence: DIIs have increased their holding to 14.57% in March 2025 from 14.46% in December 2024, while FIIs have increased their holding to 10.64% in March 2025 from 9.52% in December 2024, indicating a strong institutional confidence in the company’s future growth prospects.

Cons of Castrol India

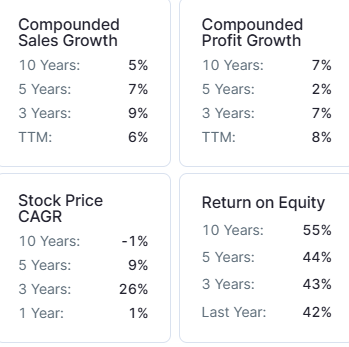

- Poor Sales Growth – Castrol India has delivered a poor sales growth of 5% over the last 10 years.

- Poor Profit Growth – Castrol India profit has grown at a CAGR of just 2% over the last 5 years, showing weak earnings growth over time.

- High Price-to-Book (P/B) Ratio: The company’s P/B ratio stands at 9.64, which is significantly higher than the industry average. This high ratio may indicate that the stock is overpriced relative to its book value and poses a risk of price correction.

- Impact of Electric Vehicles (EVs): The rise of EVs could reduce demand for traditional lubricants, affecting Castrol India’s future revenue. The company’s reliance on automotive lubricants, which contribute over 80% of its revenue, makes it vulnerable to this shift.

- Volatile Raw Material Costs: Fluctuations in base oil prices can impact profit margins. For example, in the July-September 2024 quarter, expenses grew by 9.5%, with the cost of raw and packing materials increasing by 9%, which could pressure profitability.

- Poor Profit Growth – Castrol India profit has grown at a CAGR of just 2% over the last five years, showing weak earnings growth over time.

- High Price to Book Value: Castrol India is trading at a Price-to-Book Value (P/B) ratio of 8.68, which indicates that its stock is significantly overvalued compared to its book value.

Castrol India Ltd Balance Sheet

| Particulars | Dec 2022 | Dec 2023 | Dec 2024 |

|---|---|---|---|

| Equity Capital | 495 | 495 | 495 |

| Reserves | 1,391 | 1,627 | 1,784 |

| Borrowings | 50 | 77 | 82 |

| Other Liabilities | 1,133 | 1,221 | 1,275 |

| Total Liabilities | 3,069 | 3,420 | 3,635 |

| Fixed Assets | 261 | 259 | 319 |

| CWIP | 61 | 108 | 60 |

| Investments | 325 | 488 | 488 |

| Other Assets | 2,422 | 2,565 | 2,769 |

| Total Assets | 3,069 | 3,420 | 3,635 |

By the end of 2025, the Castrol India share price is expected to be around ₹260 in normal conditions. In a bear market, it might be ₹250, and in a bull market, it may cross its 52-week high of ₹300.

| Castrol India Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 250 |

| 2nd Target | 260 |

| 3rd Target | 300 |

In 2026, the Castrol India share price is expected to be around ₹350 in a normal situation. In a bear market, it might be ₹300, and in a bull market, it may cross ₹450.

| Castrol India Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 300 |

| 2nd Target | 350 |

| 3rd Target | 450 |

According to our analysis, the Castrol India share price is expected to be around ₹380 in 2027. In a bear market, it might be ₹350, and in a bull market, it may cross ₹500.

| Castrol India Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 350 |

| 2nd Target | 380 |

| 3rd Target | 500 |

According to our analysis, the Castrol India share price may trade near ₹500 by 2028; bearish conditions could pull it down to ₹450, while a strong bull run might lift it to ₹650.

| Castrol India Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 450 |

| 2nd Target | 500 |

| 3rd Target | 650 |

In a normal situation, the Castrol India share price is projected to be approximately ₹600 in 2029. In a bear market, the value may be as low as ₹550, while in a bull market, it may rise to ₹900.

| Castrol India Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 550 |

| 2nd Target | 600 |

| 3rd Target | 900 |

In a normal situation, the Castrol India share price is projected to be approximately ₹700 in 2030. In a bear market, the value may be as low as ₹650, while in a bull market, it may rise to ₹1150.

| Castrol India Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 650 |

| 2nd Target | 700 |

| 3rd Target | 1150 |

By 2035, the Castrol India share price is projected to be around ₹1500 under normal conditions. In adverse markets, the price could fall to ₹1250, while favorable conditions might push it up to ₹3400.

| Castrol India Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 1250 |

| 2nd Target | 1500 |

| 3rd Target | 3400 |

Under normal conditions, the Castrol India share price might hit ₹2500 by 2040. A bearish trend could lower it to ₹4500, whereas a bullish surge could raise it to ₹10,500.

| Castrol India Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 2500 |

| 2nd Target | 4500 |

| 3rd Target | 10,500 |

In 2050, the Castrol India share price is expected to be around ₹25,000 in a normal situation. In a bear market, it might be ₹10,000, and in a bull market, it may go up to ₹62,000.

| Castrol India Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 10,000 |

| 2nd Target | 25,000 |

| 3rd Target | 62,000 |

| Years | Target Price |

|---|---|

| Castrol India Share Price Target 2025 | ₹250 to ₹300 |

| Castrol India Share Price Target 2026 | ₹300 to ₹450 |

| Castrol India Share Price Target 2027 | ₹350 to ₹500 |

| Castrol India Share Price Target 2028 | ₹450 to ₹650 |

| Castrol India Share Price Target 2029 | ₹550 to ₹900 |

| Castrol India Share Price Target 2030 | ₹650 to ₹1150 |

| Castrol India Share Price Target 2035 | ₹1250 to ₹3400 |

| Castrol India Share Price Target 2040 | ₹2500 to ₹10,500 |

| Castrol India Share Price Target 2050 | ₹10,000 to ₹62,000 |

Conclusion

Castrol India has been a strong player in the lubricant industry for over a century, thanks to its parent company BP. Castrol India has a well-established brand, strategic partnerships, and plans to expand into rural markets, indicating the potential for steady growth. However, challenges such as slow sales and profit growth, increased EV adoption, and fluctuating raw material costs may have an impact on the company’s long-term performance. While the company’s strong financials, high ROE and ROCE, and low debt make it attractive, investors should also consider the risks before making investment decisions. For the latest updates, you can visit Castrol India’s official website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: Hindalco Share Price Target 2025 to 2050