Bharat Dynamics Limited, commonly known as BDL, was listed on the NSE on March 23, 2018. In the last five years, its stock has given a massive return of more than 1270% to its investors. Will BDL continue to provide such impressive returns in the future as well? Let’s explore the BDL growth potential and the BDL share price target 2025 to 2050 in this article.

About BDL

Bharat Dynamics Limited (BDL) is an Indian PSU company under the Ministry of Defence that makes missiles and other defense equipment for the military. It was started in 1970 by the Indian government to help make the country stronger in defence. BDL works with DRDO (Defence Research and Development Organisation) to develop and produce different types of missiles, like anti-tank and surface-to-air missiles.

BDL Business Model

- Making Missiles: BDL makes different types of missiles, like anti-tank and air defense missiles. The Indian government buys these for the Army, Navy, and Air Force.

- Selling to the Indian Military: Most of BDL’s money comes from selling weapons and defense equipment to the Indian military under government orders.

- Selling to Other Countries: BDL also sells some of its products to other countries, which helps it earn more money.

- Repair and Maintenance Services: BDL helps the military by repairing and maintaining the weapons it sells.

- Making Spare Parts: BDL also makes and sells spare parts for missiles and other defense systems.

BDL Fundamental Analysis

BDL Fundamental Analysis

| Stock Name | Bharat Dynamics Ltd. |

|---|---|

| NSE Symbol | BDL |

| Market Cap | ₹ 54,372 Crores |

| 52W High | ₹ 1,795 |

| 52W Low | ₹ 890 |

| Stock P/E | 96.1 |

| Book Value | ₹ 102 |

| Dividend Yield | 0.34 % |

| ROCE | 24.2 % |

| ROE | 17.9% |

| Face Value | ₹ 5.00 |

| Industry PE | 79.9 |

| Price to book value | 14.6 |

| Debt to equity | 0.00 |

| PEG Ratio | 12.4 |

| Quick ratio | 2.31 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 74.93% | 74.93% | 74.93% |

| FIIs | 2.83% | 2.95% | 3.25% |

| DIIs | 14.10% | 12.39% | 9.45% |

| Public | 8.15% | 9.72% | 12.35% |

| No. of Shareholders | 1,66,501 | 2,48,158 | 5,67,591 |

Key Factors Driving BDL’s Future Growth

- Government Support: Bharat Dynamics Limited (BDL) benefits from strong backing through India’s “Make in India” initiative, which promotes domestic defense manufacturing.

- Strong Order Book: BDL has secured orders worth over ₹1,800 crore, reflecting strong demand for its missile systems and defense products. This healthy order book supports revenue growth and long-term stability.

- Technological Advancements and R&D: Collaborations with the Defence Research and Development Organisation (DRDO) and investments in research enable BDL to develop advanced missiles and defense technologies, enhancing its competitive edge.

- Export Opportunities: BDL is tapping into international markets with cost-competitive, indigenized products like Akash SAM and ATGMs, driven by rising interest from friendly countries.

- Diversified Product Portfolio: Expansion into new markets, such as air defence systems and underwater weaponry, reduces reliance on a single product line, promoting resilience and growth.

- Infrastructure Expansion: New manufacturing facilities enable BDL to scale production, meet growing demand, and handle larger projects efficiently.

Pros of Investing in BDL

- Strong Financial Health: Bharat Dynamics Limited (BDL) is a debt-free company.

- Key Role in India’s Defence: As a major supplier of missiles and defense equipment to the Indian Armed Forces, BDL has a reliable demand for its products.

- Government Backing: Being a government-owned company, BDL benefits from strong support and policy advantages, enhancing its growth prospects.

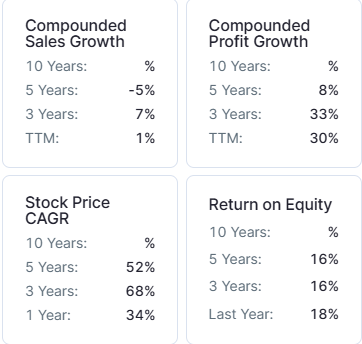

- Strong Profit Growth: BDL’s profits have grown at a CAGR of 33% over the last three years.

- High Return on Capital Employed (ROCE): BDL’s 5yrs average ROCE is 21.9%, which shows that it is utilizing its capital effectively to generate profits.

- Increase in Institutional Confidence: DIIs have increased their holding to 9.45% in March 2025 from 8.70% in December 2024, while FIIs have increased their holding to 3.25% in March 2025 from 3.09% in December 2024, indicating a strong institutional confidence in the company’s future growth prospects.

Cons of Investing in BDL

- Dependency on Government Orders: BDL mainly sells products to the Indian military. If the government reduces spending on defense, BDL might not get enough orders and could lose money.

- Stock Price Volatility: BDL’s stock price is too volatile, which might be risky for investors.

- Decreasing Sales – BDL’s sales have been decreasing at a CAGR of -5% over the last five years.

- Overvaluation Concern: BDL stock is trading at a PE ratio of 96.1 and a (P/B) ratio of 14.6, which shows that its stock is significantly overvalued compared to its earnings and assets.

BDL Ltd Balance Sheet

| Particulars | March 2023 | March 2024 | Sept 2024 |

|---|---|---|---|

| Equity Capital | 183 | 183 | 183 |

| Reserves | 3,028 | 3,454 | 3,549 |

| Borrowings | 9 | 8 | 3 |

| Other Liabilities | 5,535 | 6,781 | 6,795 |

| Total Liabilities | 8,756 | 10,426 | 10,530 |

| Fixed Assets | 809 | 824 | 865 |

| CWIP | 74 | 73 | 97 |

| Investments | 0 | 0 | 4 |

| Other Assets | 7,873 | 9,530 | 9,564 |

| Total Assets | 8,756 | 10,426 | 10,530 |

BDL’s share price target for 2025 is expected to be between ₹1600 and ₹2000, driven by a strong order book, higher government spending on local defense production, and growing exports.

| BDL Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 1600 |

| 2nd Target | 1650 |

| 3rd Target | 2000 |

In 2026, the BDL share price is expected to be around ₹2020 in a normal situation. In a bear market, it might be ₹1920, and in a bull market, it may cross ₹2340.

| BDL Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 1920 |

| 2nd Target | 2020 |

| 3rd Target | 2340 |

According to our analysis, the BDL share price is expected to be around ₹2550 in 2027. In a bear market, it might be ₹2300, and in a bull market, it may cross ₹3050.

| BDL Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 2300 |

| 2nd Target | 2550 |

| 3rd Target | 3050 |

According to our analysis, the BDL share price may trade near ₹2950 by 2028; bearish conditions could pull it down to ₹2750, while a strong bull run might lift it to ₹3950.

| BDL Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 2750 |

| 2nd Target | 2950 |

| 3rd Target | 3950 |

In a normal situation, the BDL share price is projected to be approximately ₹3550 in 2029. In a bear market, the value may be as low as ₹3300, while in a bull market, it may rise to ₹5140.

| BDL Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 3300 |

| 2nd Target | 3550 |

| 3rd Target | 5140 |

By 2030, if Bharat Dynamics Limited (BDL) secures major long-term defense contracts, significantly expands its export markets, and innovates in advanced missile and defense technologies, the BDL share price target for 2030 is projected to be around ₹4,500 in stable market conditions. In a bear market, it could reach ₹4,000, while in a bull market, it may exceed ₹6,680.

| BDL Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 4000 |

| 2nd Target | 4500 |

| 3rd Target | 6680 |

By 2035, the BDL share price is projected to be around ₹9500 under normal conditions. In adverse markets, the price could fall to ₹8000, while favorable conditions might push it up to ₹20,000.

| BDL Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 8000 |

| 2nd Target | 9500 |

| 3rd Target | 20,000 |

Under normal conditions, the BDL share price might hit ₹19500 by 2040. A bearish trend could lower it to ₹16000, whereas a bullish surge could raise it to ₹55000.

| BDL Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 16000 |

| 2nd Target | 19500 |

| 3rd Target | 55000 |

In 2050, the BDL share price is expected to be around ₹75,000 in a normal situation. In a bear market, it might be ₹60,000, and in a bull market, it may go up to ₹2,00,000.

| BDL Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 60,000 |

| 2nd Target | 75,000 |

| 3rd Target | 2,00,000 |

| Years | Target Price |

|---|---|

| BDL Share Price Target 2025 | ₹1600 to ₹2000 |

| BDL Share Price Target 2026 | ₹1920 to ₹2340 |

| BDL Share Price Target 2027 | ₹2300 to ₹3050 |

| BDL Share Price Target 2028 | ₹2750 to ₹3950 |

| BDL Share Price Target 2029 | ₹3300 to ₹5140 |

| BDL Share Price Target 2030 | ₹4000 to ₹6680 |

| BDL Share Price Target 2035 | ₹8000 to ₹20,000 |

| BDL Share Price Target 2040 | ₹16,000 to ₹55,000 |

| BDL Share Price Target 2050 | ₹60,000 to ₹2,00,000 |

Conclusion

Bharat Dynamics Limited (BDL) plays an important role in India’s defense sector, providing missiles and other defense products to the Indian military. It has strong financial health and is growing with the support of the government. However, there are some risks, like its valuation, dependency on government orders, and limited product options. For more information, you can visit: BDL official website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.