Apollo Tyres was listed on the NSE on May 31, 1995. In the last five year, its stock has given a massive return of more than 440%. Will Apollo Tyres continue to provide such great returns in the future as well? Let’s explore Apollo Tyres’ growth potential and Apollo Tyres’ share price target from 2025 to 2050 in this article.

About Apollo Tyres

Apollo Tyres is an Indian tyre manufacturing company that was established in 1972. It makes tyres for cars, bikes, trucks, and other vehicles. The company sells its products in many countries and has manufacturing plants in India and abroad. Apollo Tyres is known for making durable and high-performance tyres used in different road conditions.

Apollo Tyres Business Model

- Selling Tyres: Apollo Tyres manufactures and sells tyres for a variety of vehicles, including cars, bikes, trucks, and buses. It makes money by selling tyres in various markets.

- OEM Partnerships: As an Original Equipment Manufacturer (OEM), Apollo Tyres supplies tyres to major automotive manufacturers. These companies install Apollo tyres in new vehicles, generating a steady income.

- Replacement Market Sales: Many vehicle owners use Apollo Tyres to replace their old tyres. The replacement market is a significant source of revenue for the company.

- Exports to Other Countries: Apollo Tyres sells its products in many countries outside of India, including Europe and the United States.

- Speciality Tyres: Apollo Tyres also manufactures tires for specialised applications such as farming (tractor tyres), mining, and construction. These speciality tyres generate additional income.

- Tyre Repair Services: The company offers retreading services, which involve giving worn-out tyres new life. This helps customers save money while also generating revenue for Apollo Tyres.

- Allied Services and Solutions: Apollo Tyres generates revenue by providing tyre-related services such as tyre care, maintenance, and digital tyre solutions.

Apollo Tyres Fundamental Analysis

| Stock Name | Apollo Tyres Ltd. |

|---|---|

| NSE Symbol | APOLLOTYRE |

| Market Cap | ₹ 30990 Cr. |

| 52W High | ₹ 585 |

| 52W Low | ₹ 368 |

| Stock P/E | 23.0 |

| Book Value | ₹ 225 |

| Dividend Yield | 1.23 % |

| ROCE | 16.4 % |

| ROE | 13.2 % |

| Face Value | ₹ 1.00 |

| Industry PE | 28.8 |

| Price to book value | 2.17 |

| Debt to equity | 0.34 |

| PEG Ratio | 1.43 |

| Quick ratio | 0.57 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 37.34% | 37.36% | 37.36% |

| FIIs | 22.35% | 18.16% | 13.43% |

| DIIs | 17.78% | 21.99% | 26.51% |

| Government | 1.57% | 1.57% | 1.57% |

| Public | 20.94% | 20.93% | 21.13% |

| No. of Shareholders | 2,82,649 | 3,72,372 | 4,27,248 |

Key Factors Driving Apollo Tyres Future Growth

- Increasing Demand for Vehicles: As more people buy cars and trucks, the demand for tyres rises. Apollo Tyres benefits from the growing market.

- Expansion into Global Markets: Apollo Tyres is expanding into Europe, the United States, and other countries, allowing it to grow beyond India.

- Strong Brand and Reputation: Apollo Tyres has a strong brand and reputation, which attracts more customers.

- Focus on Research and Development: Apollo Tyres invests in new technologies to produce better tyres, such as those that are more fuel efficient and last longer.

- Growth in Electric Vehicles (EVs): As electric vehicles become popular, Apollo Tyres is developing special tyres for them, creating a new market opportunity.

- Wide Distribution Network: Apollo Tyres has a strong presence in both urban and rural areas, ensuring that its products reach more customers.

- Partnerships with Automakers: Apollo Tyres collaborates with major car and truck manufacturers, which boosts sales.

- Focus on Sustainability: Apollo Tyres is developing eco-friendly tyres and sustainable manufacturing to attract environmentally conscious customers.

- Increasing Exports: Apollo Tyres exports tyres to a number of countries, allowing it to generate more revenue from international markets.

- Government Support for Manufacturing: The Indian government’s push for local manufacturing through schemes such as “Make in India” aids Apollo Tyres’ growth.

- Rising Demand for Commercial Vehicles: As more trucks and buses are used for transportation, the demand for Apollo Tyres’ products grows.

- Cost Control and Efficiency: Apollo Tyres is working to reduce costs and improve efficiency, which will boost profits.

- Innovation in Tyre Technology: Apollo Tyres is investing in smart tyres and other innovations to stay ahead of the competition.

Pros of Apollo Tyres

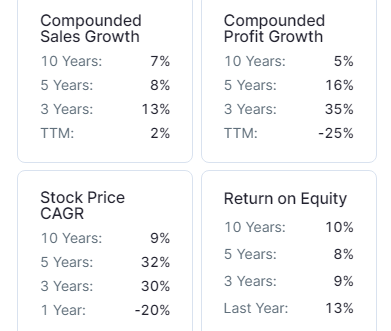

- Strong Profit Growth: Apollo Tyres has achieved a strong profit growth of 35% CAGR over the last three years.

- Low P/B Ratio (Undervalued Stock): Apollo Tyres has a low Price to Book Value (P/B) ratio of 1.77, which indicates that it is trading close to its intrinsic value and may be undervalued.

- Low PE Ratio Compared to Peers: Apollo Tyres has a PE ratio of 19.1, which is lower than the industry average of 24.6, making it relatively undervalued and potentially a good investment opportunity.

- Low Debt Levels: With a low debt-to-equity ratio of 0.34, Apollo Tyres has a minimum dependency on debt which reduces its financial risk and interest expenses.

- Increase in DIIs Holding: Domestic Institutional Investors (DIIs) have increased their holding to 26.12% in December 2024 from 25.56% in September 2024, which indicates growing confidence in the Apollo Tyres future potential by the DIIs.

- Low PE Ratio Compared to Peers: Apollo Tyres PE ratio is 23.0, which is lower than the industry average of 28.8, making it relatively undervalued and potentially a good investment opportunity.

- Low Debt Levels: Apollo Tyres debt to equity ratio is 0.34, which indicates that the company is less dependent on debt, which reduces its financial risk.

- Increase in DIIs Holding: DIIs holding increased from 26.12% in December 2024 to 26.51% in March 2025, showing a positive outlook towards Apollo Tyres by the DIIs.

Cons of Apollo Tyres

- Low Return on Equity (ROE): Apollo Tyres’ 5-year average ROE is 7.97%, which shows inefficient use of shareholder funds to generate profits.

- Low Return on Capital Employed (ROCE): Apollo Tyres’ 5-year average ROCE is 9.63%, which shows inefficient use of its capital to generate profits.

- Low Promoter Holding: Apollo Tyres’s promoter holding is 37.4%, which is relatively low. This may indicate low promoter confidence and less control over decision-making, allowing outside investors to have more influence.

- Decrease in FIIs Holding: Foreign Institutional Investors (FIIs) have reduced their holding to 14.21% in December 2024 from 14.55% in September 2024, indicating a decline in FII’s confidence in the company’s future growth prospects.

- Low Return on Equity (ROE): Apollo Tyres 5-year average ROE is 7.97%, which shows that it is not using shareholders’ funds efficiently to generate profits.

- Low Return on Equity (ROCE): Apollo Tyres 5-year average ROCE is 9.63%, which shows that it is not using shareholders’ funds efficiently to generate profits.

- Low Promoter Holding: Apollo Tyres promoter holding is 37.4%, which is relatively low. This may indicate low promoter confidence and less control over decision-making, allowing outside investors to have more influence.

- Decrease in FIIs Holding: Foreign Institutional Investors (FIIs) have reduced their holding to 13.43% in March 2025 from 14.21% in December 2024, indicating a decline in FII’s confidence in the company’s future growth prospects.

Apollo Tyres Ltd Balance Sheet

| Particulars | March 2023 | March 2024 | Sept 2024 |

|---|---|---|---|

| Equity Capital | 64 | 64 | 64 |

| Reserves | 12,515 | 13,839 | 14,245 |

| Borrowings | 6,421 | 4,905 | 4,801 |

| Other Liabilities | 8,282 | 8,068 | 8,396 |

| Total Liabilities | 27,281 | 26,875 | 27,505 |

| Fixed Assets | 17,653 | 17,006 | 16,774 |

| CWIP | 253 | 348 | 421 |

| Investments | 436 | 532 | 43 |

| Other Assets | 8,940 | 8,989 | 10,267 |

| Total Assets | 27,281 | 26,875 | 27,505 |

By the end of 2025, the Apollo Tyres share price is expected to be around ₹615 in normal conditions. In a bear market, it might be ₹610 and in a bull market, it may cross its 52-week high of ₹630.

| Apollo Tyres Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 610 |

| 2nd Target | 615 |

| 3rd Target | 630 |

In 2026, the Apollo Tyres share price is expected to be around ₹750 in a normal situation. In a bear market, it might be ₹730, and in a bull market, it may cross ₹820.

| Apollo Tyres Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 730 |

| 2nd Target | 750 |

| 3rd Target | 820 |

According to our analysis, the Apollo Tyres share price is expected to be around ₹900 in 2027. In a bear market, it might be ₹880, and in a bull market, it may cross ₹1060.

| Apollo Tyres Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 880 |

| 2nd Target | 900 |

| 3rd Target | 1060 |

According to our analysis, the Apollo Tyres share price may trade near ₹1210 by 2028; bearish conditions could pull it down to ₹1060, while a strong bull run might lift it to ₹1400.

| Apollo Tyres Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 1060 |

| 2nd Target | 1210 |

| 3rd Target | 1400 |

In a normal situation, the Apollo Tyres share price is projected to be approximately ₹1450 in 2029. In a bear market, the value may be as low as ₹1270, while in a bull market, it may rise to ₹1800.

| Apollo Tyres Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 1270 |

| 2nd Target | 1450 |

| 3rd Target | 1800 |

In a normal situation, the Apollo Tyres share price is projected to be approximately ₹1750 in 2030. In a bear market, the value may be as low as ₹1520, while in a bull market, it may rise to ₹2340.

| Apollo Tyres Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 1520 |

| 2nd Target | 1750 |

| 3rd Target | 2340 |

By 2035, the Apollo Tyres share price is projected to be around ₹4250 under normal conditions. In adverse markets, the price could fall to ₹3040, while favorable conditions might push it up to ₹7000.

| Apollo Tyres Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 3040 |

| 2nd Target | 4250 |

| 3rd Target | 7000 |

Under normal conditions, the Apollo Tyres share price might hit ₹7890 by 2040. A bearish trend could lower it to ₹6080, whereas a bullish surge could raise it to ₹21050.

| Apollo Tyres Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 6080 |

| 2nd Target | 7890 |

| 3rd Target | 21050 |

In 2050, the Apollo Tyres share price is expected to be around ₹26500 in a normal situation. In a bear market, it might be ₹24320, and in a bull market, it may go up to ₹1,26310.

| Apollo Tyres Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 24320 |

| 2nd Target | 26500 |

| 3rd Target | 1,26310 |

| Years | Target Price |

|---|---|

| Apollo Tyres Share Price Target 2025 | ₹610 to ₹630 |

| Apollo Tyres Share Price Target 2026 | ₹730 to ₹820 |

| Apollo Tyres Share Price Target 2027 | ₹880 to ₹1060 |

| Apollo Tyres Share Price Target 2028 | ₹1060 to ₹1400 |

| Apollo Tyres Share Price Target 2029 | ₹1270 to ₹1800 |

| Apollo Tyres Share Price Target 2030 | ₹1520 to ₹2340 |

| Apollo Tyres Share Price Target 2035 | ₹3040 to ₹7000 |

| Apollo Tyres Share Price Target 2040 | ₹6080 to ₹21050 |

| Apollo Tyres Share Price Target 2050 | ₹24320 to ₹1,26310 |

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: MTNL Share Price Target 2025 to 2050