Dixon Technologies (India) Limited was listed on the NSE and BSE on September 18, 2017. In the last five years, its stock has given a massive return of more than 1100%. Will Dixon Technologies continue to provide such great returns in the future as well? Let’s explore Dixon Technologies’ growth potential and the Dixon Technologies share price target 2025 to 2050 in this article.

About Dixon Technologies

Dixon Technologies (India) Limited is one of the top electronics manufacturing services (EMS) companies in India. It was founded in 1993 by Sunil Vachani. The company operates across various segments, including consumer electronics (such as LED TVs), home appliances (like washing machines), lighting (LED bulbs and battens), mobile phones, and security devices. Dixon Technologies is a key manufacturing partner for prominent brands such as Samsung, Xiaomi, Panasonic, and Philips, both in India and globally. Dixon has more than 20 factories in India as of 2024, and the company consistently works in new areas like wearable tech and telecom products.

Dixon Technologies Business Model

- Electronics Manufacturing Services (EMS) Business: Dixon Technologies operates as a leading Electronics Manufacturing Services (EMS) provider in India, offering design-focused manufacturing solutions to global and domestic brands across various product categories such as mobile phones, LED TVs, lighting products, home appliances, wearables, medical electronics, and set-top boxes. The company partners with major brands like Samsung, Xiaomi, Panasonic, Philips, and others to manufacture products on their behalf under contract manufacturing agreements.

- Backward Integration and Component Manufacturing Business: To strengthen its value proposition and improve margins, Dixon Technologies has strategically invested in backward integration by manufacturing key components such as Printed Circuit Board Assemblies (PCBA), LED panels, plastic molding parts, and more. This ensures better supply chain control, cost competitiveness, and higher profitability, positioning Dixon as an end-to-end solutions provider in the electronics manufacturing ecosystem.

Dixon Technologies Fundamental Analysis

| Stock Name | Dixon Technologies (India) Ltd. |

|---|---|

| NSE Symbol | DIXON |

| Market Cap | ₹ 89,792 Cr. |

| 52W High | ₹ 19150 |

| 52W Low | ₹ 10,008 |

| Stock P/E | 116 |

| Book Value | ₹ 500 |

| Dividend Yield | 0.03 % |

| ROCE | 39.8 % |

| ROE | 32.9 % |

| Face Value | ₹ 2.00 |

| Industry PE | 37.9 |

| Price to book value | 29.7 |

| Debt to equity | 0.22 |

| PEG Ratio | 2.57 |

| Quick ratio | 0.72 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 36.17% | 33.44% | 32.27% |

| FIIs | 10.76% | 17.85% | 21.81% |

| DIIs | 22.95% | 27.01% | 23.07% |

| Public | 30.12% | 21.71% | 22.86% |

| No. of Shareholders | 37,843 | 2,52,843 | 3,75,630 |

Key Factors Driving Dixon Technologies Future Growth

- Government Push for Domestic Manufacturing: The Government of India’s focus on the ‘Make in India’ and ‘Atmanirbhar Bharat’ initiatives is driving large-scale investments in domestic electronics manufacturing. Dixon Technologies, as one of India’s leading Electronics Manufacturing Services (EMS) companies, stands to benefit significantly from the growing preference for locally manufactured products, especially in mobile phones, consumer electronics, and lighting solutions.

- Production-Linked Incentive (PLI) Scheme: Dixon is a key beneficiary of the PLI schemes announced for mobile phones, IT hardware, white goods, and wearables. These schemes incentivize domestic manufacturing by offering financial benefits, thereby improving Dixon’s competitiveness and profitability in both domestic and export markets.

- Rising Demand for Consumer Electronics: India’s booming middle class, rapid urbanization, and increasing disposable incomes are driving strong growth in demand for electronics such as LED TVs, washing machines, smartphones, and smart lighting solutions. Dixon’s diversified portfolio and partnerships with top brands like Samsung, Xiaomi, Motorola, and boAt position the company well to capture this demand.

- Expansion into High-Growth Sectors: Dixon is aggressively expanding into new verticals such as medical electronics, wearables, IT hardware, telecom equipment, and electric vehicle components. This diversification is expected to drive future revenue streams and reduce dependence on any single product line.

- Export Opportunities and Global Partnerships: The shift of global supply chains away from China has opened up export opportunities for Indian EMS companies. Dixon has formed strategic alliances with global brands, which is likely to boost its export revenues and make India a preferred manufacturing hub.

Pros of Dixon Technologies

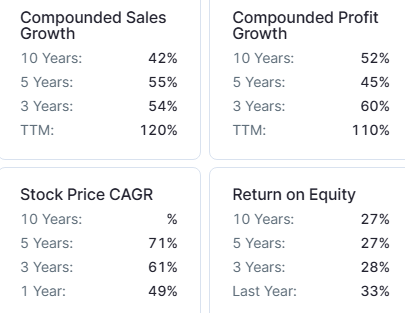

- Strong Sales Growth: Dixon Technologies sales have grown at 55% CAGR over the last five years.

- Strong Profit Growth: Dixon Technologies profits have grown at 60% CAGR over the last three years.

- High Return on Capital Employed (ROCE): Dixon Technologies 5yrs average ROCE is 29.2% which shows that the company is utilizing its capital effectively to generate profits.

- High Return on Equity (ROE): Dixon Technologies 5-year average is 27.0% which shows that the company is using its shareholders funds well to generate profits.

- Low Debt Levels: Dixon Technologies debt to equity ratio is 0.22, which indicates that the company is less dependent on debt, which reduces its financial risk.

- Increase in DIIs Holding: DIIs holding increased from 22.61% in December 2024 to 23.7% in March 2025, showing a positive outlook towards Dixon Technologies by the DIIs.

Cons of Dixon Technologies

- Overvaluation Concern: Dixon Technologies stock is trading at a PE ratio of 116 and a (P/B) ratio of 29.7, which shows that its stock is significantly overvalued compared to its earnings and assets.

- Low Promoter Holding: Dixon Technologies promoter holding is 32.3%, which is relatively low. This may indicate low promoter confidence and less control over decision-making, allowing outside investors to have more influence.

- Decrease in FIIs Holding: Foreign Institutional Investors (FIIs) have reduced their holding to 21.81% in March 2025 from 23.22% in December 2024, indicating a decline in FII’s confidence in the company’s future growth prospects.

Dixon Technologies Ltd Balance Sheet

| Particulars | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Equity Capital | 12 | 12 | 12 |

| Reserves | 1,273 | 1,683 | 2,998 |

| Borrowings | 453 | 489 | 671 |

| Other Liabilities | 2,941 | 4,806 | 13,086 |

| Total Liabilities | 4,679 | 6,990 | 16,767 |

| Fixed Assets | 1,244 | 1,996 | 2,775 |

| CWIP | 120 | 68 | 256 |

| Investments | 44 | 20 | 536 |

| Other Assets | 3,272 | 4,905 | 13,201 |

| Total Assets | 4,679 | 6,990 | 16,767 |

By the end of 2025, the Dixon Technologies share price is expected to be around ₹18,500 in normal conditions. In a bear market, it might be ₹13,400, and in a bull market, it may go up to ₹23,000.

| Dixon Technologies Share Price Target 2025 | Rupees (₹) |

|---|---|

| Bear Market | 13,400 |

| Normal Market | 18,500 |

| Bull Market | 23,000 |

In 2026, the Dixon Technologies share price is expected to be around ₹22,300, in a normal situation. In a bear market, it might be ₹14,700, and in a bull market, it may cross ₹30,000.

| Dixon Technologies Share Price Target 2026 | Rupees (₹) |

|---|---|

| Bear Market | 14,700 |

| Normal Market | 22,300 |

| Bull Market | 30,000 |

According to our analysis, the Dixon Technologies share price is expected to be around ₹26,700 in 2027. In a bear market, it might be ₹16,000, and in a bull market, it may cross ₹39,000.

| Dixon Technologies Share Price Target 2027 | Rupees (₹) |

|---|---|

| Bear Market | 16,000 |

| Normal Market | 26,700 |

| Bull Market | 39,000 |

According to our analysis, the Dixon Technologies share price may trade near ₹32,000 by 2028; bearish conditions could pull it down to ₹17,800, while a strong bull run might lift it to ₹50,500.

| Dixon Technologies Share Price Target 2028 | Rupees (₹) |

|---|---|

| Bear Market | 17,800 |

| Normal Market | 32,000 |

| Bull Market | 50,500 |

Under normal conditions, the Dixon Technologies share price might hit ₹38,500 by 2029. A bearish trend could lower it to ₹19,500, whereas a bullish surge could raise it to ₹65,800.

| Dixon Technologies Share Price Target 2029 | Rupees (₹) |

|---|---|

| Bear Market | 19,500 |

| Normal Market | 38,500 |

| Bull Market | 65,800 |

In a normal situation, the Dixon Technologies share price is projected to be approximately ₹46,000 in 2030. In a bear market, the value may be as low as ₹21,500, while in a bull market, it may rise to ₹85,500.

| Dixon Technologies Share Price Target 2030 | Rupees (₹) |

|---|---|

| Bear Market | 21,500 |

| Normal Market | 46,000 |

| Bull Market | 85,500 |

By 2035, the Dixon Technologies share price is projected to be around ₹92,000 under normal conditions. In adverse markets, the price could fall to ₹32,000, while favorable conditions might push it up to ₹2,56,500.

| Dixon Technologies Share Price Target 2035 | Rupees (₹) |

|---|---|

| Bear Market | 32,000 |

| Normal Market | 92,000 |

| Bull Market | 2,56,500 |

Under normal conditions, the Dixon Technologies share price might hit ₹1,84,000 by 2040. A bearish trend could lower it to ₹48,000, whereas a bullish surge could raise it to ₹7,69,500.

| Dixon Technologies Share Price Target 2040 | Rupees (₹) |

|---|---|

| Bear Market | 48,000 |

| Normal Market | 1,84,000 |

| Bull Market | 7,69,500 |

In 2050, the Dixon Technologies share price is expected to be around ₹7,36,000 in a normal situation. In a bear market, it might be ₹1,45,000, and in a bull market, it may go up to ₹46,17,000.

| Dixon Technologies Share Price Target 2050 | Rupees (₹) |

|---|---|

| Bear Market | 1,45,000 |

| Normal Market | 7,36,000 |

| Bull Market | 46,17,000 |

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.