Inox Wind was listed on the NSE and BSE on April 9, 2015. In the last five year, the company has given a massive return of more than 2700% to its investors. Will Inox Wind continue to provide such great returns in the future as well? Let’s explore Inox Wind’s growth potential and Inox Wind share price target from 2025 to 2050 in this article.

About Inox Wind

Inox Wind is an Indian company that manufactures wind turbines and offers wind energy solutions. It was founded in 2009 and is part of the Inox Group. The company manufactures wind turbine generators and provides wind farm development, maintenance, and operational support services.

Inox Wind Business Model

- Wind Turbine Manufacturing: Inox Wind earns money by making and selling wind turbines. These turbines generate electricity from wind energy and are sold to businesses, power companies, and government projects.

- Turnkey Wind Projects: Inox Wind provides complete wind power solutions, including setting up wind farms. It handles everything from site selection to turbine installation, making it easy for customers to start wind energy projects.

- Operations and Maintenance Services: After setting up wind farms, Inox Wind earns by maintaining and servicing the turbines. It offers long-term maintenance contracts to ensure smooth operations and efficiency.

- Wind Farm Infrastructure Development: Inox Wind helps in building the necessary infrastructure for wind farms, like roads, power transmission lines, and grid connections. This service generates additional revenue.

- Equipment and Spare Parts Sales: The company sells spare parts and equipment needed for wind turbines. This helps customers repair and upgrade their wind farms, providing a steady income for Inox Wind.

- Renewable Energy Consultancy: Inox Wind offers consultancy services to businesses and investors looking to enter the wind energy sector. It provides technical guidance and project management, adding another source of income.

Inox Wind Fundamental Analysis

| Stock Name | Inox Wind Ltd. |

|---|---|

| NSE Symbol | INOX WIND |

| Market Cap | ₹ 22034 Cr. |

| 52W High | ₹ 262 |

| 52W Low | ₹ 124 |

| Stock P/E | 71.3 |

| Book Value | ₹ 20.5 |

| Dividend Yield | 0.00 % |

| ROCE | 4.26 % |

| ROE | -1.18 % |

| Face Value | ₹ 10.0 |

| Industry PE | 50.0 |

| Price to book value | 8.29 |

| Debt to equity | 1.33 |

| PEG Ratio | 18.0 |

| Quick ratio | 0.65 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 72.01% | 52.87% | 48.27% |

| FIIs | 1.89% | 9.47% | 15.68% |

| DIIs | 0.00% | 10.16% | 9.44% |

| Public | 26.10% | 27.49% | 26.61% |

| No. of Shareholders | 53,212 | 1,17,484 | 3,80,249 |

Key Factors Driving Inox Wind Future Growth

- Government Support: INOX Wind benefits from government policies promoting renewable energy, such as subsidies, tax breaks, and renewable energy targets.

- Rising Demand for Clean Energy: As more industries and businesses transition to renewable energy, INOX Wind expects to receive more orders for wind turbines and services.

- Strong Order Book: INOX Wind receives a consistent flow of orders from various power producers, ensuring future revenue growth.

- Expansion of Wind Energy Projects: INOX Wind is expanding its wind farms throughout India, increasing its market presence and revenue potential.

- Advancements in Technology: INOX Wind is working to improve the efficiency and cost-effectiveness of its wind turbines.

- Falling Cost of Wind Energy: The cost of producing wind power is decreasing, making INOX Wind’s projects attractive to investors.

- Focus on Service Revenue: In addition to selling turbines, INOX Wind generates revenue through long-term maintenance and operational services.

- Increasing Investments in the Renewable Sector: More private and institutional investors are funding renewable projects, opening up new opportunities for INOX Wind.

- Partnerships and Collaborations: INOX Wind is partnering with power companies and developers to grow its business and install more wind energy projects.

- India’s Net-Zero Targets: The government wants to reduce carbon dioxide. which will lead to more wind energy projects in which INOX Wind can play an important role.

Pros of Inox Wind

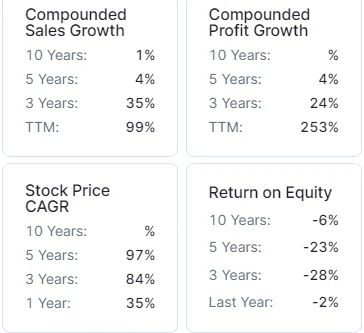

- Strong Sales Growth: Inox Wind has achieved a strong sales growth of 35% CAGR over the last three years.

- Strong Profit Growth: Inox Wind has achieved a strong profit growth of 24% CAGR over the last three years.

- Increase in DIIs Holding: Domestic Institutional Investors (DIIs) have increased their holding to 9.80% in December 2024 from 9.09% in September 2024, which indicates growing confidence in the “Company Name” future potential by the DIIs.

- Consistent Revenue Growth: Inox Wind sales have grown at 35% CAGR over the last three years.

- Consistent Profit Growth: Inox Wind profits have grown at 24% CAGR over the last three years.

- Increase in FIIs Holding: Foreign Institutional Investors (FIIs) have increased their holding to 15.68% in March 2025 from 15.26% in December 2024, which indicates growing confidence in the Inox Wind future potential by the FIIs.

Cons of Inox Wind

- Low Return on Equity (ROE): Inox Wind’s 5-year average ROE is -23.4%, which shows that Inox Wind is not using shareholder funds efficiently to generate profits.

- Low Return on Capital Employed (ROCE): Inox Wind’s 5-year average ROCE is -5.45%, indicating inefficient use of its capital to generate profits.

- Overvaluation Concern: Inox Wind is trading at a PE ratio of 68.4 and a (P/B) ratio of 7.90, which shows that its stock is significantly overvalued. This high valuation may limit future upside potential and pose a risk of correction if market sentiment changes.

- High Financial Risk: Inox Wind has a high debt-to-equity ratio of 1.33, indicating a strong dependency on debt. This increases financial risk, raises interest costs, and may have an impact on profitability.

- Decrease in FIIs Holding: Foreign Institutional Investors (FIIs) have reduced their holding to 15.26% in December 2024 from 15.82% in September 2024, indicating a decline in FII’s confidence in the company’s future growth prospects.

- Poor Sales Growth – Inox Wind has delivered a poor sales growth of 4% over the last five years.

- Poor Profit Growth – Inox Wind profit has grown at a CAGR of just 4% over the last five years, showing weak earnings growth over time.

- Low Return on Equity (ROE): Inox Wind 5-year average ROE is -23.4%, which shows that it is not using shareholders’ funds efficiently to generate profits.

- Low Return on Equity (ROCE): Inox Wind 5-year average ROCE is -5.45%, which shows that it is not using shareholders’ funds efficiently to generate profits.

- Overvaluation Concern: Inox Wind stock is trading at a PE ratio of 71.3 and a (P/B) ratio of 8.29, which shows that its stock is significantly overvalued compared to its earnings and assets.

- High Financial Risk: Inox Wind has a high debt-to-equity ratio of 1.33, indicating a strong dependency on debt. This increases financial risk, raises interest costs, and may have an impact on profitability.

- Decrease in DIIs Holding: Domestic Institutional Investors (DIIs) have reduced their holding to 9.44% in March 2025 from 9.80% in December 2024, indicating a decline in DIIs confidence in the company’s future growth prospects.

Inox Wind Ltd Balance Sheet

| Particulars | March 2023 | March 2024 | Sept 2024 |

|---|---|---|---|

| Equity Capital | 326 | 326 | 1,304 |

| Reserves | 1,387 | 1,371 | 1,365 |

| Borrowings | 2,416 | 3,248 | 3,543 |

| Other Liabilities | 1,912 | 1,849 | 2,147 |

| Total Liabilities | 6,041 | 6,795 | 8,358 |

| Fixed Assets | 1,619 | 1,813 | 1,946 |

| CWIP | 123 | 266 | 263 |

| Investments | 1 | 0 | 534 |

| Other Assets | 4,298 | 4,716 | 5,615 |

| Total Assets | 6,041 | 6,795 | 8,358 |

By the end of 2025, the Inox Wind share price is expected to be around ₹220 in normal conditions. In a bear market, it might be ₹210, and in a bull market, it may cross its 52-week high of ₹260.

| Inox Wind Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 210 |

| 2nd Target | 220 |

| 3rd Target | 260 |

In 2026, the Inox Wind share price is expected to be around ₹270 in a normal situation. In a bear market, it might be ₹250, and in a bull market, it may cross ₹340.

| Inox Wind Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 250 |

| 2nd Target | 270 |

| 3rd Target | 340 |

According to our analysis, the Inox Wind share price is expected to be around ₹340 in 2027. In a bear market, it might be ₹300, and in a bull market, it may cross ₹440.

| Inox Wind Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 300 |

| 2nd Target | 340 |

| 3rd Target | 440 |

According to our analysis, the Inox Wind share price may trade near ₹410 by 2028; bearish conditions could pull it down to ₹360, while a strong bull run might lift it to ₹570.

| Inox Wind Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 360 |

| 2nd Target | 410 |

| 3rd Target | 570 |

In a normal situation, the Inox Wind share price is projected to be approximately ₹490 in 2029. In a bear market, the value may be as low as ₹440, while in a bull market, it may rise to ₹740.

| Inox Wind Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 440 |

| 2nd Target | 490 |

| 3rd Target | 740 |

In a normal situation, the Inox Wind share price is projected to be approximately ₹650 in 2030. In a bear market, the value may be as low as ₹520, while in a bull market, it may rise to ₹970.

| Inox Wind Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 520 |

| 2nd Target | 650 |

| 3rd Target | 970 |

By 2035, the Inox Wind share price is projected to be around ₹1550 under normal conditions. In adverse markets, the price could fall to ₹1040, while favorable conditions might push it up to ₹2900.

| Inox Wind Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 1040 |

| 2nd Target | 1550 |

| 3rd Target | 2900 |

Under normal conditions, the Inox Wind share price might hit ₹2080 by 2040. A bearish trend could lower it to ₹3500, whereas a bullish surge could raise it to ₹8690.

| Inox Wind Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 2080 |

| 2nd Target | 3500 |

| 3rd Target | 8690 |

In 2050, the Inox Wind share price is expected to be around ₹8320 in a normal situation. In a bear market, it might be ₹9800, and in a bull market, it may go up to ₹52130.

| Inox Wind Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 8320 |

| 2nd Target | 9800 |

| 3rd Target | 52130 |

| Years | Target Price |

|---|---|

| Inox Wind Share Price Target 2025 | ₹210 to ₹260 |

| Inox Wind Share Price Target 2026 | ₹250 to ₹340 |

| Inox Wind Share Price Target 2027 | ₹300 to ₹440 |

| Inox Wind Share Price Target 2028 | ₹360 to ₹570 |

| Inox Wind Share Price Target 2029 | ₹440 to ₹740 |

| Inox Wind Share Price Target 2030 | ₹520 to ₹970 |

| Inox Wind Share Price Target 2035 | ₹1040 to ₹2900 |

| Inox Wind Share Price Target 2040 | ₹2080 to ₹8690 |

| Inox Wind Share Price Target 2050 | ₹8320 to ₹52130 |

Conclusion

Inox Wind has experienced impressive growth in recent years, providing significant returns to investors. With strong government support, rising demand for renewable energy, and ongoing advancements in wind technology, Inox Wind has a promising future. However, concerns about high debt, weak long-term profit growth, and overvaluation may cause risks. The company’s future success is dependent on its ability to maintain sales growth, improve profitability, and capitalize on India’s push for clean energy. For the latest updates, you can visit Inox Wind official website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: IRCON Share Price Target 2025 to 2050