Jupiter Wagons was listed on the NSE and BSE on October 18, 2010. In the last five years, the company has given a massive return of more than 450% to its investors. Will Jupiter Wagons continue to provide such great returns in the future as well? Let’s explore Jupiter Wagons’ growth potential and Jupiter Wagons share price target from 2025 to 2050 in this article.

About Jupiter Wagons

Jupiter Wagons Limited is an Indian company that manufactures railway wagons, passenger coaches, and other transportation equipment. It was established in 2006 and has evolved into a major player in the railway industry. The company sells goods wagons, brake systems and other railway components used in India’s transportation system.

Jupiter Wagons Business Model

- Railway Wagons Manufacturing: Jupiter Wagons earns money by manufacturing various types of railway wagons used to transport goods such as coal, cement, and steel. It sells these wagons to both Indian Railways and private companies.

- Freight and Passenger Coaches: Jupiter Wagons also manufactures passenger coaches and specialized goods wagons for various railway applications. These are sold to rail operators and transportation companies.

- Defense and Heavy Engineering Solutions: The company manufactures defense-related transportation equipment and heavy engineering products for the military and industrial sectors.

- Components and Spare Parts: Jupiter Wagons generates revenue by selling spare parts and railway components such as wheels, couplers, and braking systems to railway operators and industries.

- Exports: The company sells railway wagons, components, and engineering products to international clients as well.

- Technology and Innovation Services: Jupiter Wagons offers engineering solutions and new technology-based products to help railway operators improve efficiency.

- Maintenance and After-Sales Services: The company provides maintenance and repair services for wagons and railway equipment, which generates additional revenue.

Jupiter Wagons Fundamental Analysis

Jupiter Wagons Fundamental Analysis

| Stock Name | Jupiter Wagons Ltd. |

|---|---|

| NSE Symbol | JWL |

| Market Cap | ₹ 13,011 Cr. |

| 52W High | ₹ 748 |

| 52W Low | ₹ 270 |

| Stock P/E | 34.2 |

| Book Value | ₹ 60.3 |

| Dividend Yield | 0.31 % |

| ROCE | 31.7 % |

| ROE | 27.4% |

| Face Value | ₹ 10.0 |

| Shareholders | Mar 2023 | Mar 2024 | Dec 2024 |

|---|---|---|---|

| Promoters | 74.62% | 70.12% | 68.11% |

| FIIs | 0.01% | 2.28% | 3.44% |

| DIIs | 1.49% | 1.92% | 1.73% |

| Public | 23.88% | 25.68% | 26.70% |

| No. of Shareholders | 29,778 | 1,75,669 | 3,09,767 |

Key Factors Driving JWL Future Growth

- Rising Demand for Freight Wagons: Jupiter Wagons is taking on India’s growing need for railway freight transportation. As industries grow, the demand for wagons to transport goods such as coal, cement, and steel rises.

- Government Focus on Railways: The Indian government is investing heavily in railway infrastructure, including the modernisation of goods transport. This opens up more opportunities for Jupiter Wagons to secure large orders.

- Expansion into New Segments: Jupiter Wagons is expanding into new segments beyond freight wagons, including passenger coaches and metro train components. This diversification promotes long-term growth.

- Strong Order Book: Jupiter Wagons has a solid pipeline of confirmed orders, which ensures consistent revenue in the future. New contracts with Indian Railways and private players improve its position.

- Focus on Technological Upgrades: Jupiter Wagons is using modern manufacturing techniques and better materials to make its wagons more efficient and durable, so attracting more customers.

- Rising Private Participation in Rail Freight: As private logistics companies enter the railway freight business, Jupiter Wagons gains more potential clients, increasing sales.

- Increased Development and Industrialization: As cities and industries expand, so does the demand for efficient goods transportation. This benefits Jupiter Wagons because railways remain a cost-effective option.

- Sustainability Focus: With the push for greener transport, rail freight is gaining an edge over road transport. Jupiter Wagons is well positioned to profit from this shift.

Pros of Jupiter Wagons

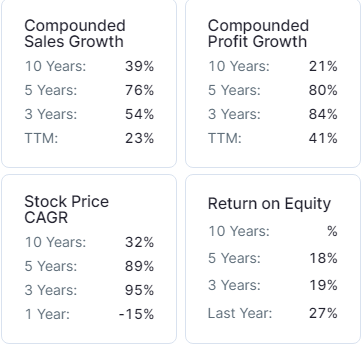

- Strong Sales Growth: Jupiter Wagons has achieved a strong sales growth of 54% CAGR over the last three years.

- Strong Profit Growth: Jupiter Wagons has achieved a strong profit growth of 84% CAGR over the last three years.

- Low PE Ratio Compared to Peers: Jupiter Wagons has a PE ratio of 34.2, which is lower than the industry average of 34.8, making it relatively undervalued and potentially a good investment opportunity.

- Low Debt Levels: With a low debt-to-equity ratio of 0.16, Jupiter Wagons has minimum dependency on debt, reducing financial risk and interest expenses.

Cons of Jupiter Wagons

- High Price to Book Value: Jupiter Wagons is trading at a Price-to-Book Value (P/B) ratio of 5.09, which indicates that its stock is significantly overvalued compared to its book value.

- Decrease in Institutional Confidence: DIIs have reduced their holding to 1.73% in December 2024 from 2.0% in September 2024 while FIIs have reduced their holding to 3.44% in December 2024 from 3.45% in September 2024, indicating a decline in institutional confidence in the company’s future growth prospects.

| Years | Target Price |

|---|---|

| Jupiter Wagons Share Price Target 2025 | ₹ 380 to 470 |

| Jupiter Wagons Share Price Target 2026 | ₹ 455 to 610 |

| Jupiter Wagons Share Price Target 2027 | ₹ 550 to 800 |

| Jupiter Wagons Share Price Target 2028 | ₹ 660 to 1050 |

| Jupiter Wagons Share Price Target 2029 | ₹ 780 to 1400 |

| Jupiter Wagons Share Price Target 2030 | ₹ 950 to 1750 |

| Jupiter Wagons Share Price Target 2035 | ₹ 1900 to 5240 |

| Jupiter Wagons Share Price Target 2040 | ₹ 3800 to 15700 |

| Jupiter Wagons Share Price Target 2050 | ₹ 15000 to 95000 |

Conclusion

Jupiter Wagons has experienced impressive growth over the last five years, providing investors with strong returns. Jupiter Wagons is well-positioned for future growth, thanks to rising goods wagon demand, government investment in railways, expansion into new markets, and export opportunities. The company’s strong order book, focus on technology, and strategic partnerships all help to strengthen its prospects. However, high valuations and a slight drop in institutional confidence raise some concerns. If Jupiter Wagons maintains its rapid growth and takes on industry trends, it has the potential to provide significant long-term returns to investors. For the latest updates, you can visit Jupiter Wagons official website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: Om Infra Share Price Target 2025 to 2050