Asian Paints Ltd. was listed on the NSE and BSE on November 3, 1994. Since listing, Asian Paints has given a massive return of around 18,900% to its investors. Will Asian Paints continue to provide such great returns in the future as well? Let’s explore Asian Paint’s future growth potential and Asian Paints share price target from 2025 to 2050 in this article

About Asian Paints

Asian Paints was started in 1942 and is one of the biggest paint companies in India. It began as a small business when there was a ban on paint imports during World War II. Over time, it grew into a well-known company that makes paints, coatings, and home improvement products. It is famous for its good quality products and new ideas.

Asian Paints Business Model

- Selling Paints: The company makes and sells different types of paints for homes, offices, and industries.

- Home Improvement Products: It also sells products like wall textures, waterproofing solutions, and wood coatings.

- Industrial Coatings: Asian Paints provides special coatings for factories, machines, and big buildings.

- Decor and Design Services: The company offers home painting and interior design services to customers.

Asian Paints Fundamental Analysis

| Stock Name | Asian Paints Ltd. |

|---|---|

| NSE Symbol | ASIANPAINT |

| Market Cap | ₹ 2,17,738 Cr. |

| 52W High | ₹ 3,395 |

| 52W Low | ₹ 2,125 |

| Stock P/E | 49.9 |

| Book Value | ₹ 188 |

| Dividend Yield | 1.47 % |

| ROCE | 37.5 % |

| ROE | 31.4 % |

| Face Value | ₹ 1.00 |

| Shareholders | Mar 2023 | Mar 2024 | Dec 2024 |

|---|---|---|---|

| Promoters | 52.63% | 52.63% | 52.63% |

| FIIs | 17.02% | 15.89% | 13.61% |

| DIIs | 9.96% | 11.61% | 13.98% |

| Goverment | 0.05% | 0.06% | 0.06% |

| Public | 20.32% | 19.78% | 19.66% |

| Others | 0.04% | 0.04% | 0.05% |

| No. of Shareholders | 10,82,650 | 1,34,831 | 11,92,876 |

Key Factors Driving Asian Paints Future Growth

- Strong Brand and Market Leadership: Asian Paints is the leading paint company in India with a strong brand presence. Its trust and reputation help it maintain and grow its market share.

- Expanding Product Range: Asian Paints is not just a paint company anymore. It has expanded into home décor, waterproofing, and adhesives, which adds to its revenue and future growth.

- Growing Demand for Home Improvement: As people spend more on home interiors and renovations, Asian Paints benefits from increasing demand for premium paints and décor solutions.

- Rural Market Expansion: Asian Paints is focusing on growing its reach in rural areas, where paint consumption is still low. As rural incomes rise, demand for its products is expected to increase.

- Innovation and Technology: Asian Paints invests in research and development to create high-quality, long-lasting, and eco-friendly paints, which keeps it ahead of competitors.

- Strong Dealer Network: Asian Paints has a vast network of dealers and retailers, ensuring its products are available everywhere, from big cities to small towns.

- Digital and Online Growth: Asian Paints is using digital tools and online platforms to improve customer experience and drive sales. Its website, apps, and online consultations make it easier for customers to choose products.

- Smart Supply Chain and Manufacturing: Asian Paints has efficient factories and a well-planned supply chain, helping it reduce costs and deliver products quickly.

- International Expansion: Asian Paints is growing its presence in other countries, especially in Asia and the Middle East, which opens new revenue streams.

- Sustainability Focus: Asian Paints is working on eco-friendly products and sustainable practices, which attract environmentally conscious customers and help meet regulatory requirements.

Pros of Asian Paints

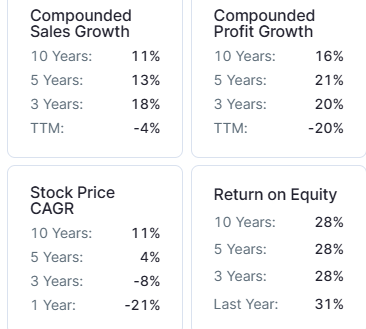

- Strong Profit Growth: Asian Paints has achieved a strong profit growth of 21% CAGR over the last five years.

- High Return on Equity (ROE): Over the last five years, Asian Paints has maintained an average ROE of 27.7%, which shows that Asian Paints is using its shareholders funds efficiently to generate profits.

- High Return on Capital Employed (ROCE): Asian Paints has maintained an average ROCE of 33.4% over the last five years, which shows that the Asian Paints is using its capital efficiently to generate profit.

- Low Debt Levels: With a low debt-to-equity ratio of 0.14, Asian Paints has a minimum dependency on debt, reducing financial risk and interest expenses.

- Increase in DIIs Holding: DIIs holding increased from 13.10% in September 2024 to 13.98% in December 2024, showing a positive outlook towards Asian Paints by the DIIs.

Cons of Asian Paints

- Overvaluation Concern: Asian Paints is trading at a PE ratio of 50.2 and a (P/B) ratio of 12.2, which shows that its stock is significantly overvalued. This high valuation may limit future upside potential and pose a risk of correction if market sentiment changes.

- Decrease in FIIs Holding: Foreign Institutional Investors (FIIs) have reduced their holding to 13.61% in December 2024 from 15.28% in September 2024, indicating a decline in FII’s confidence in the company’s future growth prospects.

| Years | Target Price |

|---|---|

| Asian Paints Share Price Target 2025 | ₹2830 to ₹3506 |

| Asian Paints Share Price Target 2026 | ₹3400 to ₹4560 |

| Asian Paints Share Price Target 2027 | ₹4080 to ₹5930 |

| Asian Paints Share Price Target 2028 | ₹4896 to ₹7710 |

| Asian Paints Share Price Target 2029 | ₹5875 to ₹10,025 |

| Asian Paints Share Price Target 2030 | ₹7050 to ₹13,030 |

| Asian Paints Share Price Target 2035 | ₹14,100 to ₹39,100 |

| Asian Paints Share Price Target 2040 | ₹28,200to ₹1,17,300 |

| Asian Paints Share Price Target 2050 | ₹1,12,800 to ₹7,03,800 |

Conclusion

Asian Paints is one of the largest and most successful paint companies in India and has a strong presence in many other countries. The company is known for its high-quality products, innovation, and customer-focused approach. Over the years, it has expanded its business beyond just paints, offering home décor and waterproofing solutions. Its strong brand image, wide distribution network, and continuous efforts in research and development have helped it stay ahead of competitors. With a focus on sustainability and digital transformation, Asian Paints continues to grow and maintain its leadership in the industry. For the latest updates, you can visit Asian Paints official website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.