Om Infra was listed on the NSE/BSE on June 17, 2011. In the last five years, its stock has given a massive return of more than 460% to its investors. Will Om Infra continue to provide such great returns in the future as well? Let’s explore Om Infra’s growth potential and the Om Infra’s share price target 2025 to 2050 in this article.

About Om Infra

Om Infra Limited is an Indian company that focusses in infrastructure and engineering projects. Established in 1971, it has worked on a variety of construction and development projects, including water resource management, dams, and real estate. The company specialises in turnkey projects involving hydroelectric power, irrigation, and urban infrastructure. Om Infra has grown its operations and established a strong presence in the infrastructure sector over the years, using its engineering expertise to help India develop.

Om Infra Business Model

- Water Infrastructure Projects: Om Infra makes money by building dams, canals, and irrigation systems for both government and private clients.

- Engineering and Construction: Om Infra generates revenue by offering engineering, procurement, and construction (EPC) services for large infrastructure projects.

- Real Estate Development: The company makes money by building and selling residential and commercial real estate properties.

- Manufacturing of Hydro-mechanical Equipment: Om Infra manufactures hydromechanical equipment for water projects and makes money by selling it to other companies.

- Operation and Maintenance Services: The company makes money by maintaining and operating water and infrastructure projects for clients after they have been completed.

- Renewable Energy Projects: Om Infra is involved in hydro and solar power projects, which generate revenue through electricity and government contracts.

Om Infra Fundamental Analysis

Om Infra Fundamental Analysis

| Stock Name | Om Infra Ltd. |

|---|---|

| NSE Symbol | OMINFRAL |

| Market Cap | ₹ 1078 Cr. |

| 52W High | ₹ 228 |

| 52W Low | ₹ 94.0 |

| Stock P/E | 44.6 |

| Book Value | ₹ 76.3 |

| Dividend Yield | 0.42% |

| ROCE | 12.2 % |

| ROE | 6.36% |

| Face Value | ₹ 1.00 |

| Industry PE | 29.8 |

| Price to book value | 1.45 |

| Debt to equity | 0.14 |

| PEG Ratio | 1.93 |

| Quick ratio | 0.74 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 71.68% | 69.09% | 67.05% |

| FIIs | 0.04% | 0.38% | 0.04% |

| DIIs | 0.00% | 0.00% | 4.06% |

| Public | 28.28% | 30.53% | 28.85% |

| No. of Shareholders | 19,907 | 26,631 | 42,309 |

Key Factors Driving Om Infra Future Growth

- Government Projects: Om Infra gets work from the government for infrastructure projects, especially in water management and construction. More government spending means more business for Om Infra.

- Rising Demand for Water Management: As cities grow, the need for better water supply and sewage systems is increasing. Om Infra benefits from this demand by building and maintaining such projects.

- Strong Order Book: Om Infra has a number of ongoing and upcoming projects, ensuring consistent revenue in the future. A strong order book indicates steady growth.

- Expansion into New Areas: Om Infra is expanding its business into new regions, which will help it grow its customer base and earnings.

- Technological Advancements: Om Infra is using better technology in construction and water management, helping it complete projects faster and at lower costs.

- Public-Private Partnerships (PPP): Om Infra works with both the government and private companies, which helps in getting large-scale projects and boosting its earnings.

- Focus on Sustainable Projects: Om Infra is working on projects that are sustainable, such as renewable energy and efficient water use, to meet future needs.

- Strong Industry Demand: India is investing heavily in infrastructure development, and Om Infra benefits from the overall growth in the sector.

- Increasing Awareness of Water Conservation: With growing concerns about water shortages, governments and industries are investing in better water management, creating more opportunities for Om Infra.

Pros of Om Infra

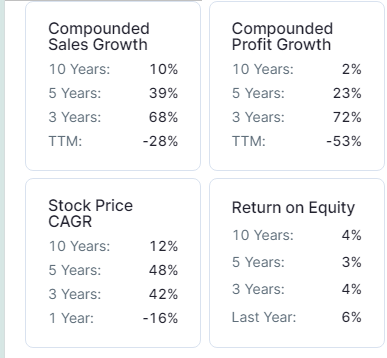

- Strong Sales Growth: Om Infra has achieved a strong sales growth of 68% CAGR over the last 3 years.

- Strong Profit Growth: Om Infra has achieved a strong profit growth of 72% CAGR over the last 3 years.

- Low P/B Ratio (Undervalued Stock): Om Infra has a low Price to Book Value (P/B) ratio of 1.64, which indicates that it is trading close to its intrinsic value and may be undervalued.

- Low Debt Levels: With a low debt-to-equity ratio of 0.14, Om Infra has a minimum dependency on debt, reducing financial risk and interest expenses.

- Increase in DIIs Holding: DIIs holding increased from 3.92% in September 2024 to 4.06% in December 2024, showing a positive outlook towards Om Infra by the DIIs.

- Consistent Revenue Growth: Om Infra sales have grown at 68% CAGR over the last three years.

- Consistent Profit Growth: Om Infra profits have grown at 72% CAGR over the last three years.

- Low P/B Ratio (Undervalued Stock): Om Infra Price to Book Value (P/B) ratio is 1.45 which shows that its stock is trading close to its intrinsic value and may be undervalued.

- Low Debt Levels: Om Infra debt to equity ratio is 0.14, which indicates that the company is less dependent on debt, which reduces its financial risk.

- Increase in FIIs Holding: Foreign Institutional Investors (FIIs) have increased their holding to 0.04% in March 2025 from 0.03% in December 2024, which indicates growing confidence in the Om Infra future potential by the FIIs.

Cons of Om Infra

- Low Return on Equity (ROE): Om Infra’s 5-year average ROE is 6.36%, which indicates inefficient use of shareholder funds to generate profits.

- Decrease in FIIs Holding: Foreign Institutional Investors (FIIs) have reduced their holding to 0.03% in December 2024 from 0.06% in September 2024, indicating a decline in FII’s confidence in the company’s future growth prospects.

- Poor Profit Growth – Om Infra profit has grown at a CAGR of just 2% over the last ten years, showing weak earnings growth over time.

- Low Return on Equity (ROE): Om Infra” 5-year average ROE is 3.09%, which shows that it is not using shareholders’ funds efficiently to generate profits.

- Low Return on Equity (ROCE): Om Infra 5-year average ROCE is 7.04%, which shows that it is not using shareholders’ funds efficiently to generate profits.

- Overvaluation Concern: Om Infra stock is trading at a PE ratio of 46.1, which is relatively higher than the industry average of 30.6 , which indicates that the stock is overvalued compared to its peers.

Om Infra Ltd Balance Sheet

| Particulars | March 2023 | March 2024 | Sept 2024 |

|---|---|---|---|

| Equity Capital | 10 | 10 | 10 |

| Reserves | 673 | 714 | 725 |

| Borrowings | 149 | 91 | 103 |

| Other Liabilities | 708 | 642 | 691 |

| Total Liabilities | 1,540 | 1,456 | 1,528 |

| Fixed Assets | 505 | 503 | 504 |

| CWIP | 11 | 1 | 1 |

| Investments | 45 | 47 | 47 |

| Other Assets | 979 | 905 | 977 |

| Total Assets | 1,540 | 1,456 | 1,528 |

By the end of 2025, the Om Infra share price is expected to be around ₹160 in normal conditions. In a bear market, it might be ₹150, and in a bull market, it may cross its 52-week high of ₹200.

| Om Infra Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 150 |

| 2nd Target | 160 |

| 3rd Target | 200 |

In 2026, the Om Infra share price is expected to be around ₹200 in a normal situation. In a bear market, it might be ₹180, and in a bull market, it may cross ₹250.

| Om Infra Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 180 |

| 2nd Target | 200 |

| 3rd Target | 250 |

According to our analysis, the Om Infra share price is expected to be around ₹230 in 2027. In a bear market, it might be ₹200, and in a bull market, it may cross ₹300.

| Om Infra Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 200 |

| 2nd Target | 230 |

| 3rd Target | 300 |

According to our analysis, the Om Infra share price may trade near ₹300 by 2028; bearish conditions could pull it down to ₹250, while a strong bull run might lift it to ₹400.

| Om Infra Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 250 |

| 2nd Target | 300 |

| 3rd Target | 400 |

In a normal situation, the Om Infra share price is projected to be approximately ₹350 in 2029. In a bear market, the value may be as low as ₹300, while in a bull market, it may rise to ₹550.

| Om Infra Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 300 |

| 2nd Target | 350 |

| 3rd Target | 550 |

In a normal situation, the Om Infra share price is projected to be approximately ₹400 in 2030. In a bear market, the value may be as low as ₹350, while in a bull market, it may rise to ₹670.

| Om Infra Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 350 |

| 2nd Target | 400 |

| 3rd Target | 650 |

By 2035, the Om Infra share price is projected to be around ₹950 under normal conditions. In adverse markets, the price could fall to ₹700, while favorable conditions might push it up to ₹2000.

| Om Infra Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 700 |

| 2nd Target | 950 |

| 3rd Target | 2000 |

Under normal conditions, the Om Infra share price might hit ₹2500 by 2040. A bearish trend could lower it to ₹1400, whereas a bullish surge could raise it to ₹6000.

| Om Infra Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 1400 |

| 2nd Target | 2500 |

| 3rd Target | 6000 |

In 2050, the Om Infra share price is expected to be around ₹7500 in a normal situation. In a bear market, it might be ₹5600, and in a bull market, it may go up to ₹36000.

| Om Infra Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 5600 |

| 2nd Target | 7500 |

| 3rd Target | 36000 |

| Years | Target Price |

|---|---|

| Om Infra Share Price Target 2025 | ₹150 to ₹200 |

| Om Infra Share Price Target 2026 | ₹180 to ₹250 |

| Om Infra Share Price Target 2027 | ₹200 to ₹300 |

| Om Infra Share Price Target 2028 | ₹250 to ₹400 |

| Om Infra Share Price Target 2029 | ₹300 to ₹550 |

| Om Infra Share Price Target 2030 | ₹350 to ₹650 |

| Om Infra Share Price Target 2035 | ₹700 to ₹2000 |

| Om Infra Share Price Target 2040 | ₹1400 to ₹6000 |

| Om Infra Share Price Target 2050 | ₹5600 to ₹36000 |

Conclusion

Om Infra has experienced rapid growth in recent years, driven by government projects, rising demand for water management, and expansion into new markets. Om Infra has the potential for consistent growth thanks to a strong order book, low debt levels, and increased infrastructure investment in India. However, factors such as low return on equity and declining FII holdings present challenges. If the company keeps using technological advancements and sustainable projects, it has the potential for significant long-term growth. For the latest updates, you can visit Om Infra’s official website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: Om Infra Share Price Target 2025 to 2050