RattanIndia Power, also known as Rattan Power, was listed on the NSE and BSE on October 30, 2009. In the last 5 years, its stock Rattan Power gave a massive return of around 780% to its investors. Will RattanIndia Power continue to provide such impressive returns in the future as well? Let’s explore RattanIndia Power’s future growth potential, Pros and Cons, and the Rattan Power’s share price target 2025 to 2050.

Rattan Power Balance Sheet

| Particulars | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Equity Capital | 5,370 | 5,370 | 5,370 |

| Reserves | -9,903 | -1,006 | -785 |

| Borrowings | 11,018 | 3,562 | 3,615 |

| Other Liabilities | 10,887 | 1,640 | 1,596 |

| Total Liabilities | 17,372 | 9,566 | 9,796 |

| Fixed Assets | 13,051 | 6,412 | 6,253 |

| CWIP | 1,110 | 67 | 65 |

| Investments | 8 | 0 | 0 |

| Other Assets | 3,203 | 3,087 | 3,478 |

| Total Assets | 17,372 | 9,566 | 9,796 |

By the end of 2025, the Rattan Power share price is expected to be around ₹12 in normal conditions. In a bear market, it might be ₹10, and in a bull market, it may go up to ₹16.

| Rattan Power Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 10 |

| 2nd Target | 12 |

| 3rd Target | 16 |

In 2026, the Rattan Power share price is expected to be around ₹16 in a normal situation. In a bear market, it might be ₹15, and in a bull market, it may cross ₹20.

| Rattan Power Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 15 |

| 2nd Target | 16 |

| 3rd Target | 20 |

According to our analysis, the Rattan Power share price is expected to be around ₹22 in 2027. In a bear market, it might be ₹20, and in a bull market, it may cross ₹30.

| Rattan Power Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 20 |

| 2nd Target | 22 |

| 3rd Target | 30 |

According to our analysis, the Rattan Power share price may trade near ₹30 by 2028; bearish conditions could pull it down to ₹22, while a strong bull run might lift it to ₹40.

| Rattan Power Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 22 |

| 2nd Target | 30 |

| 3rd Target | 40 |

In a normal situation, the Rattan Power share price is projected to be approximately ₹35 in 2029. In a bear market, the value may be as low as ₹27, while in a bull market, it may rise to ₹50.

| Rattan Power Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 27 |

| 2nd Target | 35 |

| 3rd Target | 50 |

In a normal situation, the Rattan Power share price is projected to be approximately ₹40 in 2030. In a bear market, the value may be as low as ₹30, while in a bull market, it may rise to ₹60.

| Rattan Power Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 30 |

| 2nd Target | 40 |

| 3rd Target | 60 |

By 2035, the Rattan Power share price is projected to be around ₹90 under normal conditions. In adverse markets, the price could fall to ₹60, while favorable conditions might push it up to ₹180.

| Rattan Power Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 60 |

| 2nd Target | 90 |

| 3rd Target | 180 |

Under normal conditions, the Rattan Power share price might hit ₹250 by 2040. A bearish trend could lower it to ₹120, whereas a bullish surge could raise it to ₹550.

| Rattan Power Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 120 |

| 2nd Target | 250 |

| 3rd Target | 550 |

In 2050, the Rattan Power share price is expected to be around ₹1500 in a normal situation. In a bear market, it might be ₹480, and in a bull market, it may go up to ₹3250.

| Rattan Power Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 480 |

| 2nd Target | 1500 |

| 3rd Target | 3250 |

Based on past share price momentum, company revenue, growth guidance, and future prospects, the Rattan Power share price target from 2025 to 2050 is as follows:

| Years | Target Price |

|---|---|

| Rattan Power Share Price Target 2025 | ₹10 to ₹16 |

| Rattan Power Share Price Target 2026 | ₹15 to ₹20 |

| Rattan Power Share Price Target 2027 | ₹20 to ₹30 |

| Rattan Power Share Price Target 2028 | ₹22 to ₹40 |

| Rattan Power Share Price Target 2029 | ₹27 to ₹50 |

| Rattan Power Share Price Target 2030 | ₹30 to ₹60 |

| Rattan Power Share Price Target 2035 | ₹60 to ₹180 |

| Rattan Power Share Price Target 2040 | ₹120 to ₹550 |

| Rattan Power Share Price Target 2050 | ₹480 to ₹3250 |

About RattanIndia Power Ltd.

RattanIndia Power Limited is an Indian power generation company that was founded in 2007. The company focuses on thermal power and operates large coal-fired power plants to provide electricity throughout India. Its main project is a 2,700-megawatt coal-fired power plant in Amravati, Maharashtra.

RattanIndia Power Business Model

RattanIndia Power makes money by generating and selling electricity from its coal-fired power plants. The company sells electricity to state electricity boards and distribution companies via long-term power purchase agreements (PPAs). It also sells electricity on the open market via short-term contracts and power exchanges. Revenue is generated based on the number of electricity units sold and the tariffs established in agreements or market prices.

RattanIndia Power Fundamental Analysis

| Stock Name | RattanIndia Power Ltd. |

|---|---|

| NSE Symbol | RTNPOWER |

| Market Cap | ₹ 5687 Cr. |

| 52W High | ₹ 21.1 |

| 52W Low | ₹8.44 |

| Stock P/E | 25.7 |

| Book Value | ₹8.54 |

| Dividend Yield | 0.00 % |

| ROCE | 8.69 % |

| ROE | 4.96% |

| Face Value | ₹ 10.0 |

| Industry PE | 26.8 |

| Price to book value | 1.25 |

| Debt to equity | 0.79 |

| PEG Ratio | 1.62 |

| Quick ratio | 2.71 |

| Shareholders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 44.06% | 44.06% | 44.06% |

| FIIs | 0.30% | 2.04% | 5.25% |

| DIIs | 7.20% | 6.61% | 6.65% |

| Public | 48.44% | 47.29% | 44.03% |

| No. of Shareholders | 6,91,513 | 13,22,745 | 19,73,224 |

Key Factors Driving Rattan Power Future Growth

- Rising Power Demand in India: India’s electricity demand is expected to grow at 6-7% CAGR over the next decade due to industrialization, urbanization, and increasing household consumption, it will benefit power producers like RattanIndia Power.

- Government Policy Support: Policies like UDAY (Ujwal DISCOM Assurance Yojana) and other power sector reforms benefit power generation companies like RattanIndia Power.

- 24×7 power Initiative: The government’s push for 24×7 power supply and rural electrification will benefit RattanIndia Power.

Pros of RattanIndia Power

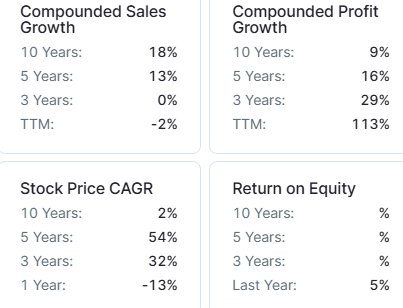

- Strong Revenue Growth: RattanIndia Power’s revenue has grown at a Compounded Annual Growth Rate (CAGR) of 26% over 10 years, showing strong financial performance.

- Increase in FIIs Holding: FIIs have been increasing their holdings in RattanIndia Power every quarter for the last 9 quarters. They have increased their holding significantly from 0.29% in December 2022 to 5.01% in December 2024.

- Debt Reduction: Rattan Power has reduced its debt from ₹11,018 crores in March 2023 to ₹3463 crores in September 2024.

- Low P/B: As of February 2025, RattanIndia Power stock is trading at a Price to Book Value (P/B) ratio of 1.17, which indicates that the stock is fairly valued in terms of its assets.

- Consistent Profit Growth: RattanIndia Power profits have grown at a CAGR of 29% over the last three years.

- Low P/B Ratio (Undervalued Stock): RattanIndia Power Price to Book Value (P/B) ratio is 1.25 which shows that its stock is trading close to its intrinsic value and may be undervalued.

- Low PE Ratio Compared to Peers: RattanIndia Power PE ratio is 25.7, which is lower than the industry average of 26.8, making it relatively undervalued and potentially a good investment opportunity.

- Increase in Institutional Confidence: DIIs have increased their holding to 6.65% in March 2025 from 6.53% in December 2024, while FIIs have increased their holding to 5.25% in March 2025 from 5.01% in December 2024, indicating a strong institutional confidence in the company’s future growth prospects.

Cons of RattanIndia Power

- High Valuation: As of February 2025, RTNPOWER is trading at a P/E ratio of 40, making it more expensive than industry peers.

- Weak Profitability: The company has struggled with low or negative profits in the past. If it fails to improve its earnings, it may not generate strong returns for investors.

- Low ROE and ROCE: The company’s ROE and ROCE are lower than industry averages, indicating inefficient use of capital and weaker profitability compared to competitors.

- High Promoter Pledge: Promoters of RattanIndia Power have pledged 88.6% of their holding, which is risky if promoters are unable to repay the loan.

- Low Return on Equity (ROCE): RattanIndia Power 5-year average ROCE is 8.81%, which shows that it is not using shareholders’ funds efficiently to generate profits.

- Low Interest Coverage Ratio: The interest coverage ratio of RattanIndia Power is 1.46, which shows that the company is struggling to pay interest.

- High Promoter Pledge: RattanIndia Power promoters have pledged 88.6% of their holding, which can be risky. If they fail to repay their loans, lenders might sell these shares, causing the stock price to fall.

Conclusion

RattanIndia Power has shown a strong stock performance over the last five years, delivering impressive returns to investors. The company benefits from rising power demand, government policy support, and improved financials, which include debt reduction and increased FII investments. However, concerns about high promoter pledging, weak profitability, and a high valuation risk its future growth. While RattanIndia Power has the potential for long-term growth, its future success will be determined by its ability to improve profitability and manage financial risks. For latest updates, check RattanIndia Power official website.

FAQ’s

What does RattanIndia Power do?

RattanIndia Power is an Indian power generation company that operates coal-fired power plants and sells electricity to state electricity boards and through power exchanges.

When was RattanIndia Power listed on the stock exchange?

RattanIndia Power was listed on the NSE and BSE on October 30, 2009.

How does RattanIndia Power earn money?

The company earns revenue by selling electricity through long-term Power Purchase Agreements (PPAs) with state electricity boards and short-term contracts in the open market.

Why is RattanIndia Power considered risky?

The company has weak profitability, low ROE and ROCE, and high promoter pledge (88.6% of promoter shares are pledged), which raises financial concerns.

Based on past momentum, revenue growth, and future prospects, the RattanIndia Power share price target for 2025 is estimated to be between ₹16 to ₹21.

By 2030, considering industry growth and company expansion, the share price target is projected to be in the range of ₹45 to ₹75.

With continued power demand and financial improvements, RattanIndia Power’s share price target for 2035 is expected to be between ₹100 to ₹250.

If the company sustains long-term growth, the share price target for 2040 is projected between ₹250 to ₹750.

By 2050, assuming strong expansion and sector growth, the share price target is expected to range from ₹1,200 to ₹5,200.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: KNR Constructions Share Price Target 2025 to 2050