Hindalco Industries Ltd. was listed on the National Stock Exchange (NSE) on January 08, 1997. In the last 5 years, its stock has given a massive return of around 450% to its investors. Will Hindalco Industries continue to provide such impressive returns this year and in the future as well? In this article, we will explore Hindalco Industries’ future growth potential and the Hindalco’s share price target 2025 to 2050.

About Hindalco Industries

Hindalco Industries Limited is an Indian company that makes aluminum and copper. It was started in 1958 and is part of the Aditya Birla Group. The company is one of the biggest aluminum producers in the world and sells its products in many countries. Its aluminum is used in buildings, cars, and packaging. Hindalco also owns Novelis Inc., which is a big company that recycles and rolls aluminum. It is listed on the BSE and NSE and helps India grow in the metal industry.

Hindalco Industries Business Model

- Aluminum Products: Hindalco makes and sells aluminum sheets, rods, and other products used in buildings, vehicles, and packaging.

- Copper Products: The company makes copper wires and rods, which are used in electrical wiring and electronics.

- Novelis: Hindalco owns Novelis, a company that makes aluminum sheets and recycles old aluminum to sell again.

- Foil and Packaging: The company makes aluminum foils used for food, medicine, and household packaging.

- Power Business: Hindalco has its own power plants. It uses electricity for its factories and sells extra power to others.

- Mining: The company mines bauxite (used to make aluminum) and sells some of it to other companies.

- Exports: Hindalco sells aluminum and copper products to many countries and earns money from foreign markets.

- Making Strong Metals: It makes special types of aluminum and copper used in airplanes, defense, and technology.

- Recycling: Hindalco collects and recycles scrap aluminum and copper, turning old metal into new products.

Hindalco Industries Fundamental Analysis

| Stock Name | Hindalco Industries Ltd. |

|---|---|

| NSE Symbol | HINDALCO |

| Market Cap | ₹ 1,40935 Cr. |

| 52W High | ₹ 773 |

| 52W Low | ₹ 546 |

| Stock P/E (TTM) | 9.73 |

| Book Value | ₹ 513 |

| Dividend Yield | 0.56 % |

| ROCE | 11.3 % |

| ROE | 10.2 % |

| Face Value | ₹ 1.00 |

| Industry PE | 18.6 |

| Price to book value | 1.22 |

| Debt to equity | 0.53 |

| PEG Ratio | 0.67 |

| Quick ratio | 0.67 |

| Share holders | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| Promoters | 34.65% | 34.65% | 34.65% |

| FIIs | 26.08% | 26.82% | 28.15% |

| DIIs | 26.20% | 25.64% | 24.68% |

| Goverment | 0.22% | 0.35% | 0.35% |

| Public | 12.44% | 12.08% | 11.71% |

| Others | 0.41% | 0.46% | 0.47% |

| No. of Shareholders | 6,76,110 | 6,41,541 | 6,81,098 |

Key Factors Driving Hindalco Industries Future Growth

- More Use of Aluminum: Hindalco Industries will grow because cars, airplanes, buildings, and packaging need more aluminum.

- More Use of Copper: Electric cars, wiring, and electronics need more copper, which will help Hindalco Industries sell more.

- Bigger Business Worldwide: Hindalco Industries owns Novelis, which is growing in many countries by selling rolled and recycled aluminum.

- Recycling: More companies want recycled aluminum and copper. Hindalco Industries is recycling more to earn more and save costs.

- More Exports: Hindalco Industries is selling more products to Europe, the U.S., and other countries, bringing in more money.

Pros of Hindalco Industries

- Strong Financial Performance: In the fiscal year ending March 2024, Hindalco reported a total income of ₹2,17,458 crore and a net profit of ₹10,155 crore.

- Leading Aluminum Producer: Hindalco is among the top five aluminum producers worldwide, benefiting from a low-cost base and a strong presence across the value chain.

- Consistent Dividend Payouts: For the fiscal year ending March 2024, Hindalco announced a 350% equity dividend of ₹3.5 per share, reflecting a consistent dividend track record over the past five years.

- Expansion into Renewable Energy: Hindalco plans to enter solar module manufacturing by setting up a plant in Gujarat, aligning with India’s goal to boost renewable energy capacity.

- Attractive Valuation: As of March 2025, the stock is trading at a Price to Earnings (P/E) ratio of below 10 and a Price to Book Value (P/B) ratio of around 1.25, indicating that the stock is relatively undervalued compared to its earnings and book value.

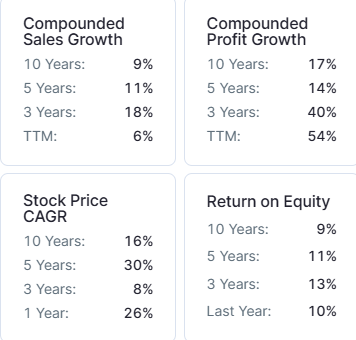

- Consistent Profit Growth: Hindalco profits have grown at 40% CAGR over the last three years.

- Low P/B Ratio (Undervalued Stock): Hindalco Price to Book Value (P/B) ratio is 1.22 which shows that its stock is trading close to its intrinsic value and may be undervalued.

- Low PE Ratio Compared to Peers: Hindalco PE ratio is 9.73, which is lower than the industry average of 18.6, making it relatively undervalued and potentially a good investment opportunity.

- Increase in Institutional Confidence: DIIs have increased their holding to 24.68% in March 2025 from 24.53% in December 2024, while FIIs have increased their holding to 28.15% in March 2025 from 27.04% in December 2024, indicating a strong institutional confidence in the company’s future growth prospects.

Cons of Hindalco Industries

- Increasing Costs: Hindalco’s expenses went up by 4%, which affects profits. A plant shutdown in Switzerland also added to the costs.

- High Debt: Hindalco has a debt-to-equity ratio of 0.53, which means it has a lot of loans. If not managed well, this could be risky.

- Too Dependent on One Company (Novelis): More than 60% of Hindalco’s money comes from its subsidiary, Novelis. If Novelis has problems, Hindalco will also suffer.

- Stock is Not Growing Fast: Over the past three years, Hindalco’s stock has given a return of 15.72%, while the Nifty 50 index gave 32.85%. This means Hindalco is growing slower than the market.

- Prices of Aluminium and Copper Affect Profit: Hindalco depends on metal prices, which keep changing. If prices go down, Hindalco will make less money.

- Low Promoter Holding: Hindalco promoter holding is 34.6%, which is relatively low. This may indicate low promoter confidence and less control over decision-making, allowing outside investors to have more influence.

Hindalco Ltd Balance Sheet

| Particulars | March 2023 | March 2024 | Sept 2024 |

|---|---|---|---|

| Equity Capital | 222 | 222 | 222 |

| Reserves | 94,584 | 105,924 | 114,954 |

| Borrowings | 60,291 | 56,356 | 60,959 |

| Other Liabilities | 68,392 | 68,221 | 76,129 |

| Total Liabilities | 223,489 | 230,723 | 252,264 |

| Fixed Assets | 110,626 | 111,810 | 111,404 |

| CWIP | 7,700 | 14,867 | 22,341 |

| Investments | 14,116 | 15,444 | 22,453 |

| Other Assets | 91,047 | 88,602 | 96,066 |

| Total Assets | 223,489 | 230,723 | 252,264 |

By the end of 2025, the Hindalco share price is expected to be around ₹810 in normal conditions. In a bear market, it might be ₹780, and in a bull market, it may cross its 52-week high of ₹970.

| Hindalco Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 780 |

| 2nd Target | 810 |

| 3rd Target | 970 |

In 2026, the Hindalco share price is expected to be around ₹1030 in a normal situation. In a bear market, it might be ₹940, and in a bull market, it may cross ₹1260.

| Hindalco Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 940 |

| 2nd Target | 1030 |

| 3rd Target | 1260 |

According to our analysis, the Hindalco share price is expected to be around ₹1250 in 2027. In a bear market, it might be ₹1130, and in a bull market, it may cross ₹1640.

| Hindalco Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 1130 |

| 2nd Target | 1250 |

| 3rd Target | 1640 |

According to our analysis, the Hindalco share price may trade near ₹1560 by 2028; bearish conditions could pull it down to ₹1350, while a strong bull run might lift it to ₹2130.

| Hindalco Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 1350 |

| 2nd Target | 1560 |

| 3rd Target | 2130 |

In a normal situation, the Hindalco share price is projected to be approximately ₹1780 in 2029. In a bear market, the value may be as low as ₹1620, while in a bull market, it may rise to ₹2770.

| Hindalco Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 1620 |

| 2nd Target | 1780 |

| 3rd Target | 2770 |

In a normal situation, the Hindalco share price is projected to be approximately ₹2150 in 2030. In a bear market, the value may be as low as ₹1950, while in a bull market, it may rise to ₹3600.

| Hindalco Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 1950 |

| 2nd Target | 2150 |

| 3rd Target | 3600 |

By 2035, the Hindalco share price is projected to be around ₹4250 under normal conditions. In adverse markets, the price could fall to ₹3900, while favorable conditions might push it up to ₹10,800.

| Hindalco Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 3900 |

| 2nd Target | 4250 |

| 3rd Target | 10,800 |

Under normal conditions, the Hindalco share price might hit ₹8500 by 2040. A bearish trend could lower it to ₹7800, whereas a bullish surge could raise it to ₹32,400.

| Hindalco Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 7800 |

| 2nd Target | 8500 |

| 3rd Target | 32,400 |

In 2050, the Hindalco share price is expected to be around ₹35500 in a normal situation. In a bear market, it might be ₹31200, and in a bull market, it may go up to ₹194400.

| Hindalco Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 31,200 |

| 2nd Target | 35,500 |

| 3rd Target | 1,94,400 |

| Years | Target Price |

|---|---|

| Hindalco Share Price Target 2025 | ₹780 to ₹970 |

| Hindalco Share Price Target 2026 | ₹940 to ₹1260 |

| Hindalco Share Price Target 2027 | ₹1130 to ₹1640 |

| Hindalco Share Price Target 2028 | ₹1350 to ₹2130 |

| Hindalco Share Price Target 2029 | ₹1620 to ₹2770 |

| Hindalco Share Price Target 2030 | ₹1950 to ₹3600 |

| Hindalco Share Price Target 2035 | ₹3900 to ₹10,800 |

| Hindalco Share Price Target 2040 | ₹7800 to ₹32,400 |

| Hindalco Share Price Target 2050 | ₹31,200 to ₹1,94,400 |

Conclusion

Hindalco Industries is a big and strong company that makes aluminium and copper. It is growing and earning more money, but there are some risks. The company has a lot of debt, and its costs are increasing. Also, its profit depends on metal prices, which can change over time. For the latest updates, visit the Hindalco Official Website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.

Also Read: Marsons Share Price Target 2025 to 2050