EMS Ltd. was listed on the NSE and BSE on September 21, 2023. In the last five years, the company its stock has given a massive return of around 120% to its investors. Will EMS continue to provide such great returns in the future as well? Let’s explore EMS’s future growth potential and the EMS share price target 2025 to 2050 in this article

About EMS Ltd.

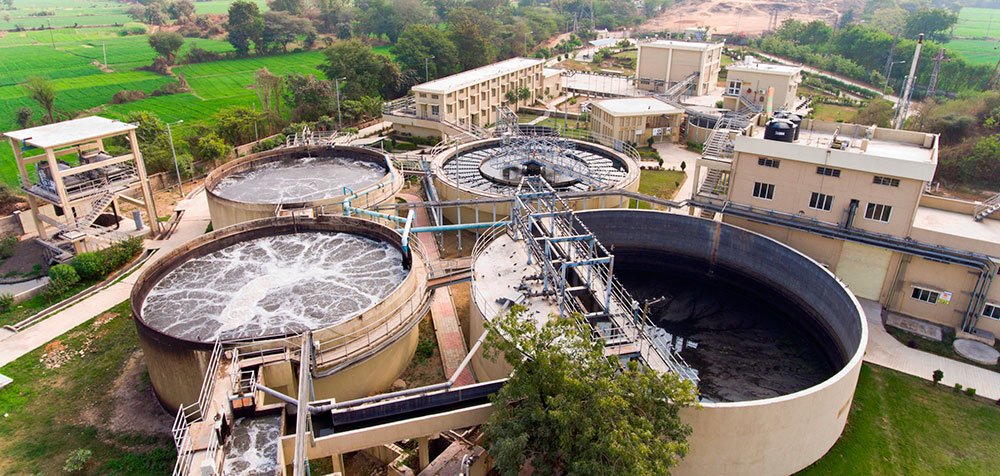

EMS Limited is a company that works on water and sewage treatment projects. It was started in 2010 and mainly does work for the government. The company builds and runs water treatment plants to make sure people get clean water and proper sewage systems. EMS helps cities and towns manage water better, making sure waste is treated properly. It has taken up many projects across India to improve water supply and sanitation.

EMS Business Model

- Government Contracts & Long-Term Deals: EMS earns by designing, building, and maintaining water and sewage systems for the government, ensuring steady income over many years.

- Project Development & Maintenance: The company not only constructs water and sewage treatment plants but also manages them, receiving regular payments.

- Growth Through New Projects: By continuously bidding for and securing new contracts, EMS expands its business and revenue.

EMS Fundamental Analysis

| Stock Name | EMS Ltd. |

|---|---|

| NSE Symbol | EMSLIMITED |

| Market Cap | ₹ 3294 Cr. |

| 52W High | ₹ 1,017 |

| 52W Low | ₹ 392 |

| Stock P/E | 17.8 |

| Book Value | ₹ 159 |

| Dividend Yield | 0.34 % |

| ROCE | – % |

| ROE | – % |

| Face Value | ₹ 10.0 |

| Industry PE | 19.9 |

| Price to book value | 3.72 |

| Debt to equity | 0.09 |

| PEG Ratio | – |

| Quick ratio | 5.61 |

| Shareholders | March 2024 | March 2025 |

|---|---|---|

| Promoters | 69.70% | 69.70% |

| FIIs | 2.78% | 0.19% |

| DIIs | 1.43% | 0.61% |

| Public | 26.08% | 29.51% |

| No. of Shareholders | 43,841 | 1,28,071 |

Key Factors Driving EMS Future Growth

- More Government Work & Rules: EMS Limited benefits from government projects and policies that focus on water and sewage management, ensuring steady work and revenue.

- High Demand & Expansion: The need for clean water and sewage treatment is rising across India, allowing EMS Limited to expand into new cities and states.

- Strong Project Pipeline & Long-Term Revenue: The company already has many ongoing projects, including long-term contracts, ensuring financial stability and consistent income.

- Technology & Efficiency: By using advanced technology, EMS Limited completes projects faster and at lower costs, improving profitability.

- Environmental & Public Awareness: Growing concerns about pollution and the demand for clean water drive more opportunities for EMS Limited’s services.

Pros of Investing in EMS

- Strong Business: The company mainly works in water and sewage projects (about 70% of its business). This is an important sector with steady demand.

- Good Leadership: The company is run by experienced managers who are skilled in handling business and finances well.

- Strong Sales Growth: EMS’ sales have grown at a 34% CAGR over the last three years.

- Strong Profit Growth: EMS’ profits have grown at a 27% CAGR over the last three years.

- High Return on Capital Employed (ROCE): EMS’ 5yrs average ROCE is 33.0% which shows that it is utilizing its capital effectively to generate profits.

- Low PE Ratio Compared to Peers: EMS PE ratio is 17.8, which is lower than the industry average of 19.9, making it relatively undervalued and potentially a good investment opportunity.

- Debt Free Company: EMS is almost debt free company with a debt to equity ratio of 0.09, which shows its financial stability.

- Increase in DIIs Holding: DIIs holding increased from 0.40% in December 2024 to 0.61% in March 2025, showing a positive outlook towards EMS by the DIIs.

Cons of Investing in EMS

- Stock Price is Unstable (Volatile): The stock has gone as high as ₹1,016.9 and as low as ₹353.4 in the past year. Such big ups and downs can be risky for investors looking for stable returns.

- High Price to Book Value: EMS is trading at a Price-to-Book Value (P/B) ratio of 3.72, which indicates that its stock is significantly overvalued compared to its book value.

- Decrease in FIIs Holding: Foreign Institutional Investors (FIIs) have reduced their holding to 0.19% in March 2025 from 0.40% in December 2024, indicating a decline in FII’s confidence in the company’s future growth prospects.

EMS Ltd Balance Sheet

| Particulars | March 2023 | March 2024 | Sept 2024 |

|---|---|---|---|

| Equity Capital | 47 | 56 | 56 |

| Reserves | 444 | 743 | 829 |

| Borrowings | 45 | 71 | 79 |

| Other Liabilities | 103 | 101 | 118 |

| Total Liabilities | 639 | 970 | 1,082 |

| Fixed Assets | 54 | 94 | 97 |

| CWIP | 4 | 0 | 0 |

| Investments | 2 | 10 | 18 |

| Other Assets | 579 | 866 | 967 |

| Total Assets | 639 | 970 | 1,082 |

By the end of 2025, the EMS share price is expected to be around ₹800 in normal conditions. In a bear market, it might be ₹750, and in a bull market, it may go up to ₹950.

| EMS Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 750 |

| 2nd Target | 800 |

| 3rd Target | 950 |

In 2026, the EMS share price is expected to be around ₹1000 in a normal situation. In a bear market, it might be ₹900, and in a bull market, it may cross ₹1200.

| EMS Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 900 |

| 2nd Target | 1000 |

| 3rd Target | 1200 |

According to our analysis, the EMS share price is expected to be around ₹1200 in 2027. In a bear market, it might be ₹1050, and in a bull market, it may cross ₹1550.

| EMS Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 1050 |

| 2nd Target | 1200 |

| 3rd Target | 1550 |

According to our analysis, the EMS share price may trade near ₹1550 by 2028; bearish conditions could pull it down to ₹1300, while a strong bull run might lift it to ₹2050.

| EMS Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 1300 |

| 2nd Target | 1550 |

| 3rd Target | 2050 |

In a normal situation, the EMS share price is projected to be approximately ₹1900 in 2029. In a bear market, the value may be as low as ₹1550, while in a bull market, it may rise to ₹2650.

| EMS Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 1550 |

| 2nd Target | 1900 |

| 3rd Target | 2650 |

In a normal situation, the EMS share price is projected to be approximately ₹2000 in 2030. In a bear market, the value may be as low as ₹1850, while in a bull market, it may rise to ₹3400.

| EMS Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 1850 |

| 2nd Target | 2000 |

| 3rd Target | 3400 |

By 2035, the EMS share price is projected to be around ₹5500 under normal conditions. In adverse markets, the price could fall to ₹3650, while favorable conditions might push it up to ₹10,500.

| EMS Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 3650 |

| 2nd Target | 5500 |

| 3rd Target | 10,500 |

Under normal conditions, the EMS share price might hit ₹14,000 by 2040. A bearish trend could lower it to ₹7300, whereas a bullish surge could raise it to ₹30,700.

| EMS Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 7300 |

| 2nd Target | 14,000 |

| 3rd Target | 30,700 |

In 2050, the EMS share price is expected to be around ₹50,000 in a normal situation. In a bear market, it might be ₹29,500, and in a bull market, it may go up to ₹1,84,000.

| EMS Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 29,500 |

| 2nd Target | 50,000 |

| 3rd Target | 1,84,000 |

| Years | Target Price |

|---|---|

| EMS Share Price Target 2025 | ₹750 to ₹950 |

| EMS Share Price Target 2026 | ₹900 to ₹1200 |

| EMS Share Price Target 2027 | ₹1050 to ₹1550 |

| EMS Share Price Target 2028 | ₹1300 to ₹2050 |

| EMS Share Price Target 2029 | ₹1550 to ₹2650 |

| EMS Share Price Target 2030 | ₹1850 to ₹3400 |

| EMS Share Price Target 2035 | ₹3650 to ₹10,500 |

| EMS Share Price Target 2040 | ₹7300 to ₹30,700 |

| EMS Share Price Target 2050 | ₹29,500 to ₹1,84,000 |

Conclusion

EMS Limited is a growing company with strong profits, low debt, and a good business model in water and sewage projects. However, the stock price is also highly volatile, and foreign investors have reduced their holdings, which could be a warning sign. For the latest updates, check the EMS Ltd. official website.

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.