Franklin Industries was listed on the BSE in November 2016. In the last 5 years, its stock has given a massive return of more than 450%. Will Franklin Industries continue to provide such massive returns in 2025 and the future years as well? In this article, we will explore Franklin Industries’ growth potential and Franklin Industries share price target 2025 to 2050.

| Years | Target Price |

|---|---|

| Franklin Industries Share Price Target 2025 | ₹2.5 to ₹3.25 |

| Franklin Industries Share Price Target 2026 | ₹3 to ₹4.20 |

| Franklin Industries Share Price Target 2027 | ₹3.6 to ₹5.5 |

| Franklin Industries Share Price Target 2028 | ₹4.4 to ₹7.4 |

| Franklin Industries Share Price Target 2029 | ₹5 to ₹9 |

| Franklin Industries Share Price Target 2030 | ₹6 to ₹15 |

| Franklin Industries Share Price Target 2035 | ₹15 to ₹35 |

| Franklin Industries Share Price Target 2040 | ₹30 to ₹100 |

| Franklin Industries Share Price Target 2050 | ₹100 to ₹550 |

About Franklin Industries

Franklin Industries Limited was established in February 1983 in Ahmedabad, Gujarat. It focusses on trading agricultural commodities like wheat, rice, maize, and various fruits and vegetables. The company also engages in contract farming, providing farmers technical assistance and inputs to promote sustainable agricultural practices.

Franklin Industries Business Model

- Agricultural Commodity Trading: Franklin Industries trades agricultural products such as wheat, rice, maize, and fruits and vegetables. The company acts as a link between farmers and buyers, ensuring quality produce reaches the market.

- Contract Farming Services: Franklin Industries contributes in contract farming by providing technical assistance, ingredients such as seeds and fertilisers, and support to farmers. In exchange, the company purchases agricultural produce directly from these farmers, and then trades or sells to open markets to generate revenue.

- Domestic and International Trade: Franklin Industries exports agricultural commodities to various countries, increasing its revenue sources and capitalising on global demand for Indian agricultural products. This international presence allows it to maintain consistent revenues even when the domestic market fluctuates.

Franklin Industries Fundamental Analysis

| Stock Name | Franklin Industries Ltd. |

|---|---|

| Market Cap | ₹ 58.7 Cr. |

| 52W High | ₹ 4.13 |

| 52W Low | ₹ 1.69 |

| Stock P/E (TTM) | 3.16 |

| Book Value | ₹ 2.18 |

| Dividend Yield | 0.00 % |

| ROCE | 120 % |

| ROE | 112 % |

| Face Value | ₹ 1.00 |

| Industry PE | 28.8 |

| Price to book value | 0.93 |

| Debt to equity | 0.00 |

| PEG Ratio | 0.02 |

| Quick ratio | 8.72 |

Key Factors Driving Franklin Industries Growth

- Rising Demand for Agricultural Commodities: With a growing global population, demand for food and agricultural products is steadily increasing. Franklin Industries is well positioned to capitalise on this trend by supplying high-quality commodities to both domestic and international markets.

- Focus on Sustainable Farming Practices: As awareness of sustainable agriculture grows, Franklin Industries’ initiatives to promote eco-friendly and efficient farming practices may attract more farmers to collaborate with them, which will improve their supply chain and reputation.

- Expansion of Export Markets: By entering new international markets and strengthening its presence in existing ones, Franklin Industries can diversify its revenue streams and reduce dependency on a single region, ensuring consistent growth.

- Technological Advancements: The use of advanced agricultural technology and data-driven practices can boost crop yields and simplify operations, helping the company stay competitive and efficient.

- Government Support for Agriculture: Government Policies and subsidies that promote agricultural growth and exports in India create a favourable environment for companies like Franklin Industries to grow.

- Growing Consumer Preference for Quality: As more consumers want high-quality and trustworthy food, Franklin Industries can focus on providing top-quality produce to gain loyal customers and attract buyers willing to pay more.

- Expansion into Value-Added Products: Diversifying into the processing and packaging of agricultural products can help Franklin Industries increase profit margins and meet the growing demand for ready-to-eat foods.

- Partnerships and Collaborations: Strategic collaborations with farmers, suppliers, and logistics companies can help Franklin Industries improve efficiency, lower costs, and strengthen its market position.

Pros of Franklin Industries

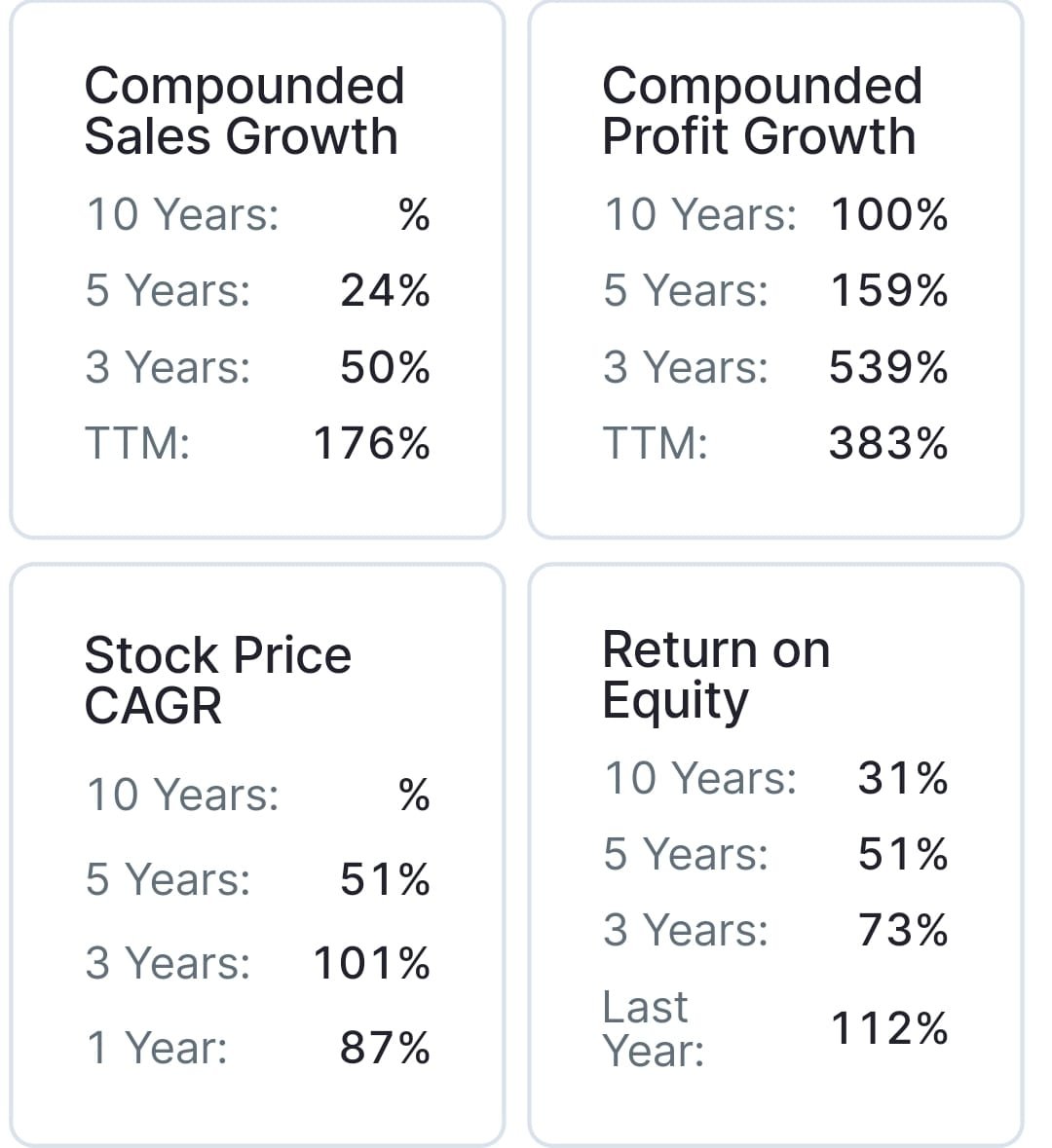

- Strong Sales Growth: Franklin Industries’ sales have grown at 50% CAGR over the last three years.

- Strong Profit Growth: Franklin Industries’ profits have grown at 539% CAGR over the last three years.

- High Return on Equity (ROE): Franklin Industries’ 5-year average is 50.9% which shows that the company is using its shareholders funds well to generate profits.

- High Return on Capital Employed (ROCE): Franklin Industries’ 5yrs average ROCE is 38.6% which shows that the company is utilizing its capital effectively to generate profits.

- Attractive Valuation: Franklin Industries’ stock is currently trading at a PE ratio of 3.16, indicating a fair valuation compared to its earnings.

- Debt Free Company: Franklin Industries is a debt free company with a debt to equity ratio of 0, which shows its financial stability.

- Low P/B Ratio (Undervalued Stock): Franklin Industries’ Price to Book Value (P/B) ratio is 0.93, which shows that its stock is trading below its intrinsic value.

Cons of Franklin Industries

- Low Promoter Holding: Franklin Industries’ promoter holding is 0%, which indicates low promoter confidence and less control over decision-making.

- High Volatility: Franklin Industries is a small-cap company, and its share price is highly volatile, which is risky for safe investors.

| Share holder | March 2023 | March 2024 | March 2025 |

|---|---|---|---|

| DIIs | 0% | 0.02% | 0.08% |

| Public | 100.00% | 99.98% | 99.92% |

By the end of 2025, the Franklin Industries share price is expected to be around ₹3 in normal conditions. In a bear market, it might be ₹2.5, and in a bull market, it may cross its 52-week high of ₹3.25.

| Franklin Industries Share Price Target 2025 | Rupees (₹) |

|---|---|

| 1st Target | 2.5 |

| 2nd Target | 3 |

| 3rd Target | 3.25 |

In 2026, the Franklin Industries share price is expected to be around ₹3.5 in a normal situation. In a bear market, it might be ₹3, and in a bull market, it may cross ₹4.2.

| Franklin Industries Share Price Target 2026 | Rupees (₹) |

|---|---|

| 1st Target | 3 |

| 2nd Target | 3.5 |

| 3rd Target | 4.2 |

According to our analysis, the Franklin Industries share price is expected to be around ₹4 in 2027. In a bear market, it might be ₹3.6, and in a bull market, it may cross ₹5.5.

| Franklin Industries Share Price Target 2027 | Rupees (₹) |

|---|---|

| 1st Target | 3.6 |

| 2nd Target | 4 |

| 3rd Target | 5.5 |

According to our analysis, the Franklin Industries share price may trade near ₹6 by 2028; bearish conditions could pull it down to ₹4.4, while a strong bull run might lift it to ₹7.4.

| Franklin Industries Share Price Target 2028 | Rupees (₹) |

|---|---|

| 1st Target | 4.4 |

| 2nd Target | 6 |

| 3rd Target | 7.4 |

In a normal situation, the Franklin Industries share price is projected to be approximately ₹7.5 in 2029. In a bear market, the value may be as low as ₹5, while in a bull market, it may rise to ₹9.

| Franklin Industries Share Price Target 2029 | Rupees (₹) |

|---|---|

| 1st Target | 5 |

| 2nd Target | 7.5 |

| 3rd Target | 9 |

By 2030, the Franklin Industries share price is projected to be around ₹12 under normal conditions. In adverse markets, the price could fall to ₹6, while favorable conditions might push it up to ₹15.

| Franklin Industries Share Price Target 2030 | Rupees (₹) |

|---|---|

| 1st Target | 6 |

| 2nd Target | 12 |

| 3rd Target | 15 |

By 2035, the Franklin Industries share price is projected to be around ₹20 under normal conditions. In adverse markets, the price could fall to ₹15, while favorable conditions might push it up to ₹35.

| Franklin Industries Share Price Target 2035 | Rupees (₹) |

|---|---|

| 1st Target | 15 |

| 2nd Target | 20 |

| 3rd Target | 35 |

Under normal conditions, the Franklin Industries share price might hit ₹50 by 2040. A bearish trend could lower it to ₹30, whereas a bullish surge could raise it to ₹100.

| Franklin Industries Share Price Target 2040 | Rupees (₹) |

|---|---|

| 1st Target | 30 |

| 2nd Target | 50 |

| 3rd Target | 100 |

In 2050, the Franklin Industries share price is expected to be around ₹250 in a normal situation. In a bear market, it might be ₹100, and in a bull market, it may go up to ₹550.

| Franklin Industries Share Price Target 2050 | Rupees (₹) |

|---|---|

| 1st Target | 100 |

| 2nd Target | 250 |

| 3rd Target | 550 |

Disclaimer

This article is for educational purposes only. It is not a stock recommendation and should not be treated as such. Please ask your financial advisor before making any investment decision.